Glycolic Acid Market Trends, Forecast Analysis, and Growth Drivers (2025-2032)

Glycolic Acid Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Glycolic Acid Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Glycolic Acid Market, with forecasts outspreading to the year.

Gain Valuable Insights – Request Your Complimentary Sample Now @

https://www.maximizemarketresearch.com/request-sample/35402/

Glycolic Acid Market Scope and Methodology:

The market research report for Glycolic Acid provides comprehensive information on important factors, such as those that are expected to drive the industry growth and future obstacles. This report provides stakeholders with a thorough understanding of the investment opportunities, product offerings, and competitive landscape of the Glycolic Acid industry. Furthermore, it is covered in the research are the sector quantitative and qualitative aspects. Within the framework of the MMR research, regional markets for the Glycolic Acid Market are evaluated in great detail.

A full description of each of the major and some of the minor components is provided by the study. Using information from primary and secondary sources, the Glycolic Acid Market was created. A number of experts and academics viewpoints, official websites, scientific publications, and annual reports.

Glycolic Acid Market Segmentation

by Grade

Technical grade

Pharmaceutical grade

Industrial grade

by Application

Personal Care & Cosmetics

Household

Textile

Industrial Cleaners

Agriculture

Others

Feel free to request a complimentary sample copy or view a summary of the report @

https://www.maximizemarketresearch.com/request-sample/35402/

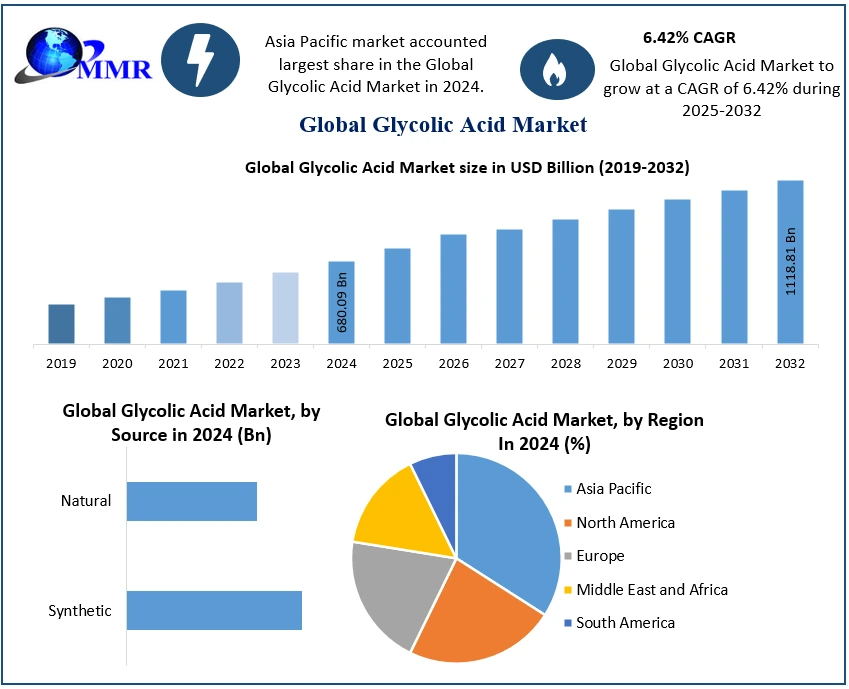

Glycolic Acid Market Regional Insights

The market size, growth rate, import and export by region, and other relevant variables are all thoroughly analysed in this research. Understanding the Glycolic Acid market conditions in different countries is feasible because to the researchs geographic examination. Africa, Latin America, the Middle East, Asia Pacific, and Europe put together make up the Glycolic Acid market.

Glycolic Acid Market Key Players

1. China Petrochemical Corporation (Sinopec Corp.), (China)

2. The Chemours Company (U.S.)

3. CABB Group (Germany)

4. Saanvi Corp (India)

5. Parchem Fine & Specialty Chemicals (U.S.)

6. Water Chemical Co., Ltd (China)

7. Shandong Xinhua Pharmaceutical Co., Ltd. (China)

8. Mehul Dye Chem Industries (India)

9. Avid Organics (India)

Key questions answered in the Glycolic Acid Market are:

What is Glycolic Acid Market?

What is the growth rate of the Glycolic Acid Market?

Which are the factors expected to drive the Glycolic Acid Market growth?

What are the different segments of the Glycolic Acid Market?

What growth strategies are the players considering to increase their presence in Glycolic Acid Market?

What are the upcoming industry applications and trends for the Glycolic Acid Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Glycolic Acid Market?

Who are the leading companies and what are their portfolios in Glycolic Acid Market?

What segments are covered in the Glycolic Acid Market?

Explore More Market Reports:

Global Advanced Carbon Materials Market

https://www.maximizemarketresearch.com/market-report/global-advanced-carbon-materials-market/72232/

Global Tight Gas Market

https://www.maximizemarketresearch.com/market-report/global-tight-gas-market/116878/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

[email protected]

+91 96071 95908, +91 9607365656

Glycolic Acid Market Trends, Forecast Analysis, and Growth Drivers (2025-2032)

Glycolic Acid Market Overview

Maximize Market Research is a Business Consultancy Firm that has published a detailed analysis of the “Glycolic Acid Market”. The report includes key business insights, demand analysis, pricing analysis, and competitive landscape. The analysis in the report provides an in-depth aspect at the current status of the Glycolic Acid Market, with forecasts outspreading to the year.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/35402/

Glycolic Acid Market Scope and Methodology:

The market research report for Glycolic Acid provides comprehensive information on important factors, such as those that are expected to drive the industry growth and future obstacles. This report provides stakeholders with a thorough understanding of the investment opportunities, product offerings, and competitive landscape of the Glycolic Acid industry. Furthermore, it is covered in the research are the sector quantitative and qualitative aspects. Within the framework of the MMR research, regional markets for the Glycolic Acid Market are evaluated in great detail.

A full description of each of the major and some of the minor components is provided by the study. Using information from primary and secondary sources, the Glycolic Acid Market was created. A number of experts and academics viewpoints, official websites, scientific publications, and annual reports.

Glycolic Acid Market Segmentation

by Grade

Technical grade

Pharmaceutical grade

Industrial grade

by Application

Personal Care & Cosmetics

Household

Textile

Industrial Cleaners

Agriculture

Others

Feel free to request a complimentary sample copy or view a summary of the report @ https://www.maximizemarketresearch.com/request-sample/35402/

Glycolic Acid Market Regional Insights

The market size, growth rate, import and export by region, and other relevant variables are all thoroughly analysed in this research. Understanding the Glycolic Acid market conditions in different countries is feasible because to the researchs geographic examination. Africa, Latin America, the Middle East, Asia Pacific, and Europe put together make up the Glycolic Acid market.

Glycolic Acid Market Key Players

1. China Petrochemical Corporation (Sinopec Corp.), (China)

2. The Chemours Company (U.S.)

3. CABB Group (Germany)

4. Saanvi Corp (India)

5. Parchem Fine & Specialty Chemicals (U.S.)

6. Water Chemical Co., Ltd (China)

7. Shandong Xinhua Pharmaceutical Co., Ltd. (China)

8. Mehul Dye Chem Industries (India)

9. Avid Organics (India)

Key questions answered in the Glycolic Acid Market are:

What is Glycolic Acid Market?

What is the growth rate of the Glycolic Acid Market?

Which are the factors expected to drive the Glycolic Acid Market growth?

What are the different segments of the Glycolic Acid Market?

What growth strategies are the players considering to increase their presence in Glycolic Acid Market?

What are the upcoming industry applications and trends for the Glycolic Acid Market?

What are the recent industry trends that can be implemented to generate additional revenue streams for the Glycolic Acid Market?

Who are the leading companies and what are their portfolios in Glycolic Acid Market?

What segments are covered in the Glycolic Acid Market?

Explore More Market Reports:

Global Advanced Carbon Materials Market https://www.maximizemarketresearch.com/market-report/global-advanced-carbon-materials-market/72232/

Global Tight Gas Market https://www.maximizemarketresearch.com/market-report/global-tight-gas-market/116878/

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

[email protected]

+91 96071 95908, +91 9607365656