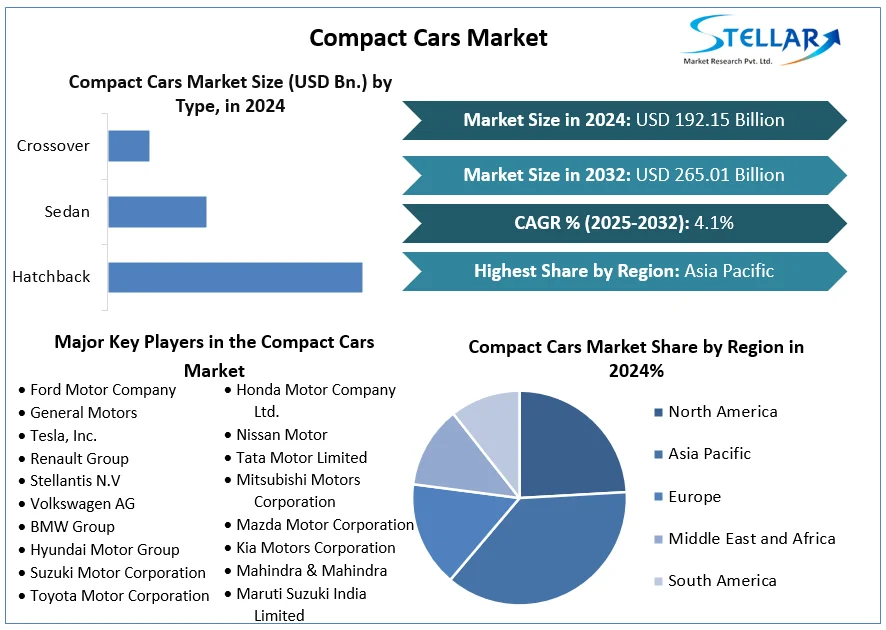

Compact Cars Market Size to Grow at a CAGR of 4.1% in the Forecast Period of 2025-2032

Global Disclosure Management Market to Reach USD 3.89 Billion by 2030 Amid Rising Regulatory Compliance and Digital Reporting Standards

Market Estimation, Growth Drivers & Opportunities

The Disclosure Management Market, valued at USD 1.56 billion in 2023, is projected to grow at a CAGR of 13.8%, reaching USD 3.89 billion by 2030, according to Stellar Market Research. This substantial growth is being driven by the surge in global financial regulations, the increasing adoption of automated reporting tools, and the need for greater transparency and accountability in financial disclosures.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Disclosure-Management-Market/2243

Businesses across industries are under immense pressure to deliver accurate, timely, and compliant reports in line with evolving regulatory standards such as IFRS, XBRL, ESMA’s ESEF, and SEC mandates. Manual disclosure processes often lead to errors, delays, and compliance risks, which is accelerating the adoption of cloud-based disclosure management solutions.

Key growth drivers include:

Rising adoption of cloud-based financial reporting platforms

Integration of AI and machine learning for automated data validation

Globalization of compliance standards across capital markets

Digital transformation initiatives in corporate finance and audit departments

Opportunities abound in:

Expanding into emerging markets with rising regulatory frameworks

Development of multi-lingual and cross-border disclosure systems

Solutions that integrate real-time collaboration and ERP platforms

U.S. Market Trends and Investments in 2024

In 2024, the U.S. market witnessed accelerated growth as the Securities and Exchange Commission (SEC) expanded requirements for structured data reporting. With the full rollout of Inline XBRL mandates for operating companies, demand for integrated, automated disclosure platforms surged.

Key players like Workiva and Oracle increased their investments in AI-driven compliance analytics and real-time audit trails. Workiva, in particular, launched a new module supporting ESG disclosures aligned with SEC’s proposed climate-risk reporting rules, enabling public companies to simplify compliance and enhance stakeholder trust.

Market Segmentation: Leading Segment by Share

Among the segments, the Software segment holds the largest market share. This is attributed to the growing demand for end-to-end disclosure solutions that offer document management, workflow control, compliance validation, and integration with financial systems. As enterprises increasingly favor SaaS-based platforms, the software segment is poised for continued dominance.

Competitive Analysis: Top 5 Key Players

Oracle Corporation

Oracle remains a market leader, offering its Hyperion Disclosure Management suite integrated with enterprise performance management tools. In 2024, Oracle invested in AI-powered anomaly detection features to streamline audit workflows and reduce human error in compliance reports.

SAP SE

SAP continues to innovate with its Disclosure Management for SAP S/4HANA, enabling seamless integration of financial data and regulatory reporting. SAP expanded cloud capabilities in 2024, emphasizing automation in ESG and risk disclosures.

Workiva Inc.

A leading innovator, Workiva launched Wdata enhancements that enable real-time collaboration between finance, legal, and sustainability teams. Workiva’s unified platform supports multiple compliance standards including SOX, ESG, and ESEF, positioning it strongly in global markets.

IRIS Business Services Ltd.

This India-based global player provides robust XBRL and inline XBRL solutions. In 2024, IRIS announced partnerships with regulators in Europe and Southeast Asia, enabling the adoption of centralized filing and compliance portals for public and private entities.

Certent (a part of insightsoftware)

Certent expanded its Disclosure Management solution with features for automated SEC filings, financial close reporting, and ESG data integration. In 2024, the company focused on simplifying report authoring and reducing compliance cycle times for mid-sized enterprises.

Regional Analysis: USA, UK, Germany, France, Japan, China

USA: Holds the largest share of the global market, driven by strict SEC compliance, widespread XBRL adoption, and the early transition to digital reporting formats. Government policies supporting financial transparency and modernization are further propelling market growth.

UK: The Financial Reporting Council (FRC) is pushing firms toward better digital disclosure, especially as the UK aligns with international standards post-Brexit. UK’s strong fintech ecosystem fosters innovation in financial reporting tools.

Germany: Germany leads in the EU due to robust corporate governance and adherence to the European Single Electronic Format (ESEF). Local firms are integrating AI into disclosure systems for internal auditing and validation purposes.

France: With the enforcement of ESEF and increasing ESG reporting requirements, French companies are adopting cloud-based disclosure solutions. The government supports digitization in finance under its France Relance initiative, further boosting this market.

Japan: The Japanese Financial Services Agency is advancing the use of XBRL-based filing and is incentivizing financial firms to modernize their reporting infrastructures. Japan's high IT maturity is an enabler for automated disclosure adoption.

China: China is expanding its regulatory framework and has launched initiatives under the CSRC to improve transparency in listed companies. Disclosure management tools that support multi-language, multi-format outputs are in high demand as companies seek foreign investments.

Conclusion

The Disclosure Management Market is transforming into a cornerstone of modern corporate governance. As regulatory compliance becomes more stringent and digitized, companies are turning to intelligent, scalable, and collaborative platforms that minimize errors and ensure consistent reporting.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Compact Cars Market Size to Grow at a CAGR of 4.1% in the Forecast Period of 2025-2032

Global Disclosure Management Market to Reach USD 3.89 Billion by 2030 Amid Rising Regulatory Compliance and Digital Reporting Standards

Market Estimation, Growth Drivers & Opportunities

The Disclosure Management Market, valued at USD 1.56 billion in 2023, is projected to grow at a CAGR of 13.8%, reaching USD 3.89 billion by 2030, according to Stellar Market Research. This substantial growth is being driven by the surge in global financial regulations, the increasing adoption of automated reporting tools, and the need for greater transparency and accountability in financial disclosures.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Disclosure-Management-Market/2243

Businesses across industries are under immense pressure to deliver accurate, timely, and compliant reports in line with evolving regulatory standards such as IFRS, XBRL, ESMA’s ESEF, and SEC mandates. Manual disclosure processes often lead to errors, delays, and compliance risks, which is accelerating the adoption of cloud-based disclosure management solutions.

Key growth drivers include:

Rising adoption of cloud-based financial reporting platforms

Integration of AI and machine learning for automated data validation

Globalization of compliance standards across capital markets

Digital transformation initiatives in corporate finance and audit departments

Opportunities abound in:

Expanding into emerging markets with rising regulatory frameworks

Development of multi-lingual and cross-border disclosure systems

Solutions that integrate real-time collaboration and ERP platforms

U.S. Market Trends and Investments in 2024

In 2024, the U.S. market witnessed accelerated growth as the Securities and Exchange Commission (SEC) expanded requirements for structured data reporting. With the full rollout of Inline XBRL mandates for operating companies, demand for integrated, automated disclosure platforms surged.

Key players like Workiva and Oracle increased their investments in AI-driven compliance analytics and real-time audit trails. Workiva, in particular, launched a new module supporting ESG disclosures aligned with SEC’s proposed climate-risk reporting rules, enabling public companies to simplify compliance and enhance stakeholder trust.

Market Segmentation: Leading Segment by Share

Among the segments, the Software segment holds the largest market share. This is attributed to the growing demand for end-to-end disclosure solutions that offer document management, workflow control, compliance validation, and integration with financial systems. As enterprises increasingly favor SaaS-based platforms, the software segment is poised for continued dominance.

Competitive Analysis: Top 5 Key Players

Oracle Corporation

Oracle remains a market leader, offering its Hyperion Disclosure Management suite integrated with enterprise performance management tools. In 2024, Oracle invested in AI-powered anomaly detection features to streamline audit workflows and reduce human error in compliance reports.

SAP SE

SAP continues to innovate with its Disclosure Management for SAP S/4HANA, enabling seamless integration of financial data and regulatory reporting. SAP expanded cloud capabilities in 2024, emphasizing automation in ESG and risk disclosures.

Workiva Inc.

A leading innovator, Workiva launched Wdata enhancements that enable real-time collaboration between finance, legal, and sustainability teams. Workiva’s unified platform supports multiple compliance standards including SOX, ESG, and ESEF, positioning it strongly in global markets.

IRIS Business Services Ltd.

This India-based global player provides robust XBRL and inline XBRL solutions. In 2024, IRIS announced partnerships with regulators in Europe and Southeast Asia, enabling the adoption of centralized filing and compliance portals for public and private entities.

Certent (a part of insightsoftware)

Certent expanded its Disclosure Management solution with features for automated SEC filings, financial close reporting, and ESG data integration. In 2024, the company focused on simplifying report authoring and reducing compliance cycle times for mid-sized enterprises.

Regional Analysis: USA, UK, Germany, France, Japan, China

USA: Holds the largest share of the global market, driven by strict SEC compliance, widespread XBRL adoption, and the early transition to digital reporting formats. Government policies supporting financial transparency and modernization are further propelling market growth.

UK: The Financial Reporting Council (FRC) is pushing firms toward better digital disclosure, especially as the UK aligns with international standards post-Brexit. UK’s strong fintech ecosystem fosters innovation in financial reporting tools.

Germany: Germany leads in the EU due to robust corporate governance and adherence to the European Single Electronic Format (ESEF). Local firms are integrating AI into disclosure systems for internal auditing and validation purposes.

France: With the enforcement of ESEF and increasing ESG reporting requirements, French companies are adopting cloud-based disclosure solutions. The government supports digitization in finance under its France Relance initiative, further boosting this market.

Japan: The Japanese Financial Services Agency is advancing the use of XBRL-based filing and is incentivizing financial firms to modernize their reporting infrastructures. Japan's high IT maturity is an enabler for automated disclosure adoption.

China: China is expanding its regulatory framework and has launched initiatives under the CSRC to improve transparency in listed companies. Disclosure management tools that support multi-language, multi-format outputs are in high demand as companies seek foreign investments.

Conclusion

The Disclosure Management Market is transforming into a cornerstone of modern corporate governance. As regulatory compliance becomes more stringent and digitized, companies are turning to intelligent, scalable, and collaborative platforms that minimize errors and ensure consistent reporting.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]