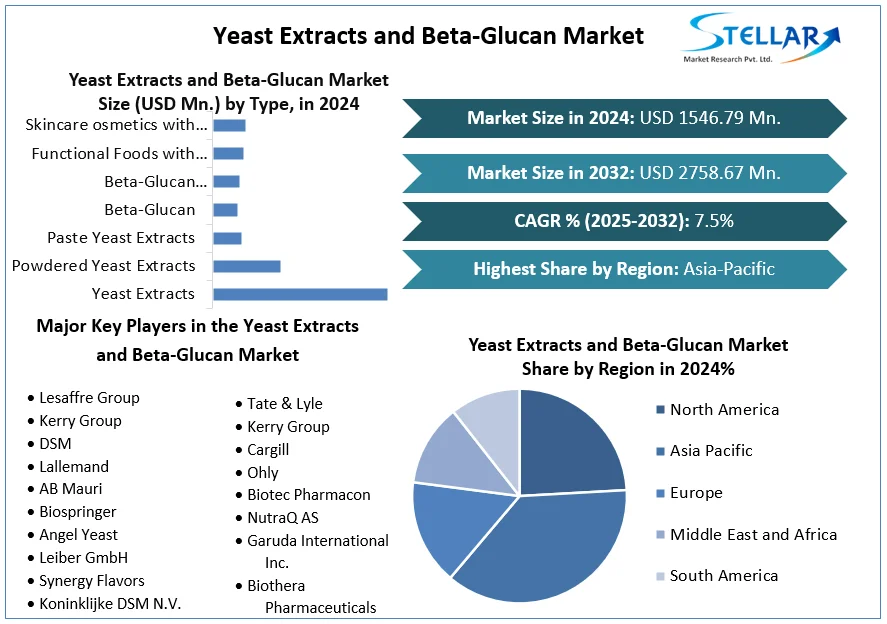

Yeast Extracts and Beta-Glucan Market Size to Grow at a CAGR of 7.5% in the Forecast Period of 2025-2032

Yeast Extracts and Beta Glucan Market: Driving Growth in Food, Pharma, and Nutraceuticals

1. Market Estimation & Definition

The Yeast Extracts and Beta Glucan Market is experiencing robust growth, driven by rising demand in the food & beverage, pharmaceuticals, and nutraceuticals industries. Yeast extracts are widely used as natural flavor enhancers and nutritional supplements, while beta glucans, derived from yeast cell walls, are recognized for their immune-boosting and cholesterol-lowering properties. Valued at several billion USD in 2024, the market is forecast to witness steady expansion through 2032, supported by the shift toward natural, clean-label, and functional ingredients.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Yeast-Extracts-and-Beta-Glucan-Market/1549

2. Market Growth Drivers & Opportunities

Health & Wellness Trends: Rising consumer preference for natural and functional food ingredients.

Growing Nutraceutical Demand: Beta glucan’s role in immunity, heart health, and gut health enhances adoption.

Pharmaceutical Advancements: Applications in vaccine adjuvants, cancer therapy, and chronic disease management.

Clean Label Movement: Food manufacturers replacing artificial flavor enhancers with natural yeast extracts.

Opportunities in Emerging Markets: Rising disposable incomes and health awareness in Asia-Pacific present major growth avenues.

3. What Lies Ahead: Emerging Trends Shaping the Future

Fortified Food & Beverages: Enriched products using beta glucan for immunity support.

Biotechnology Integration: Innovative fermentation processes to enhance yield and purity.

Sustainable Production: Eco-friendly yeast cultivation and extraction methods gaining importance.

Pharma-Nutrition Convergence: Cross-industry collaborations creating multifunctional supplements.

Personalized Nutrition: Customized supplements with yeast extracts and beta glucans targeting specific health concerns.

4. Segmentation Analysis

The market is segmented by:

Product Type: Yeast Extracts, Beta Glucan.

Application: Food & Beverages, Pharmaceuticals, Nutraceuticals, Animal Feed.

Form: Powder, Liquid.

Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

5. Country-Level Analysis: USA & Germany

United States: A key market with growing adoption of beta glucan-based nutraceuticals and fortified foods. Strong FDA support for health claims related to cholesterol management drives growth.

Germany: Known for its advanced pharmaceutical and food sectors, Germany leads European demand for yeast-based natural flavor enhancers and immune health supplements.

6. Competitor Analysis

The competitive landscape is characterized by a mix of global food ingredient giants and biotech innovators:

Key Players: Angel Yeast Co., Kerry Group, Lesaffre, Lallemand, ABF Ingredients, and Biotec Pharmacon.

Strategies: Players are investing in R&D to improve extraction methods, developing premium-grade beta glucans, and expanding into health-conscious emerging markets.

Challenges: High production costs and regulatory complexities may hinder growth.

Opportunities: Expanding use in functional foods, dietary supplements, and chronic disease management offers immense potential.

7. Press Release Conclusion

The Yeast Extracts and Beta Glucan Market is at the forefront of the health-driven transformation in global food and pharma industries. With rising consumer demand for natural, functional, and immune-boosting products, the market is expected to see strong expansion in the coming years. The U.S. and Germany are driving innovation, while Asia-Pacific is emerging as a major growth hub. Companies leveraging biotechnology, sustainable practices, and personalized nutrition trends will be best positioned to lead this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Yeast Extracts and Beta Glucan Market: Driving Growth in Food, Pharma, and Nutraceuticals

1. Market Estimation & Definition

The Yeast Extracts and Beta Glucan Market is experiencing robust growth, driven by rising demand in the food & beverage, pharmaceuticals, and nutraceuticals industries. Yeast extracts are widely used as natural flavor enhancers and nutritional supplements, while beta glucans, derived from yeast cell walls, are recognized for their immune-boosting and cholesterol-lowering properties. Valued at several billion USD in 2024, the market is forecast to witness steady expansion through 2032, supported by the shift toward natural, clean-label, and functional ingredients.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Yeast-Extracts-and-Beta-Glucan-Market/1549

2. Market Growth Drivers & Opportunities

Health & Wellness Trends: Rising consumer preference for natural and functional food ingredients.

Growing Nutraceutical Demand: Beta glucan’s role in immunity, heart health, and gut health enhances adoption.

Pharmaceutical Advancements: Applications in vaccine adjuvants, cancer therapy, and chronic disease management.

Clean Label Movement: Food manufacturers replacing artificial flavor enhancers with natural yeast extracts.

Opportunities in Emerging Markets: Rising disposable incomes and health awareness in Asia-Pacific present major growth avenues.

3. What Lies Ahead: Emerging Trends Shaping the Future

Fortified Food & Beverages: Enriched products using beta glucan for immunity support.

Biotechnology Integration: Innovative fermentation processes to enhance yield and purity.

Sustainable Production: Eco-friendly yeast cultivation and extraction methods gaining importance.

Pharma-Nutrition Convergence: Cross-industry collaborations creating multifunctional supplements.

Personalized Nutrition: Customized supplements with yeast extracts and beta glucans targeting specific health concerns.

4. Segmentation Analysis

The market is segmented by:

Product Type: Yeast Extracts, Beta Glucan.

Application: Food & Beverages, Pharmaceuticals, Nutraceuticals, Animal Feed.

Form: Powder, Liquid.

Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

5. Country-Level Analysis: USA & Germany

United States: A key market with growing adoption of beta glucan-based nutraceuticals and fortified foods. Strong FDA support for health claims related to cholesterol management drives growth.

Germany: Known for its advanced pharmaceutical and food sectors, Germany leads European demand for yeast-based natural flavor enhancers and immune health supplements.

6. Competitor Analysis

The competitive landscape is characterized by a mix of global food ingredient giants and biotech innovators:

Key Players: Angel Yeast Co., Kerry Group, Lesaffre, Lallemand, ABF Ingredients, and Biotec Pharmacon.

Strategies: Players are investing in R&D to improve extraction methods, developing premium-grade beta glucans, and expanding into health-conscious emerging markets.

Challenges: High production costs and regulatory complexities may hinder growth.

Opportunities: Expanding use in functional foods, dietary supplements, and chronic disease management offers immense potential.

7. Press Release Conclusion

The Yeast Extracts and Beta Glucan Market is at the forefront of the health-driven transformation in global food and pharma industries. With rising consumer demand for natural, functional, and immune-boosting products, the market is expected to see strong expansion in the coming years. The U.S. and Germany are driving innovation, while Asia-Pacific is emerging as a major growth hub. Companies leveraging biotechnology, sustainable practices, and personalized nutrition trends will be best positioned to lead this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Yeast Extracts and Beta-Glucan Market Size to Grow at a CAGR of 7.5% in the Forecast Period of 2025-2032

Yeast Extracts and Beta Glucan Market: Driving Growth in Food, Pharma, and Nutraceuticals

1. Market Estimation & Definition

The Yeast Extracts and Beta Glucan Market is experiencing robust growth, driven by rising demand in the food & beverage, pharmaceuticals, and nutraceuticals industries. Yeast extracts are widely used as natural flavor enhancers and nutritional supplements, while beta glucans, derived from yeast cell walls, are recognized for their immune-boosting and cholesterol-lowering properties. Valued at several billion USD in 2024, the market is forecast to witness steady expansion through 2032, supported by the shift toward natural, clean-label, and functional ingredients.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Yeast-Extracts-and-Beta-Glucan-Market/1549

2. Market Growth Drivers & Opportunities

Health & Wellness Trends: Rising consumer preference for natural and functional food ingredients.

Growing Nutraceutical Demand: Beta glucan’s role in immunity, heart health, and gut health enhances adoption.

Pharmaceutical Advancements: Applications in vaccine adjuvants, cancer therapy, and chronic disease management.

Clean Label Movement: Food manufacturers replacing artificial flavor enhancers with natural yeast extracts.

Opportunities in Emerging Markets: Rising disposable incomes and health awareness in Asia-Pacific present major growth avenues.

3. What Lies Ahead: Emerging Trends Shaping the Future

Fortified Food & Beverages: Enriched products using beta glucan for immunity support.

Biotechnology Integration: Innovative fermentation processes to enhance yield and purity.

Sustainable Production: Eco-friendly yeast cultivation and extraction methods gaining importance.

Pharma-Nutrition Convergence: Cross-industry collaborations creating multifunctional supplements.

Personalized Nutrition: Customized supplements with yeast extracts and beta glucans targeting specific health concerns.

4. Segmentation Analysis

The market is segmented by:

Product Type: Yeast Extracts, Beta Glucan.

Application: Food & Beverages, Pharmaceuticals, Nutraceuticals, Animal Feed.

Form: Powder, Liquid.

Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

5. Country-Level Analysis: USA & Germany

United States: A key market with growing adoption of beta glucan-based nutraceuticals and fortified foods. Strong FDA support for health claims related to cholesterol management drives growth.

Germany: Known for its advanced pharmaceutical and food sectors, Germany leads European demand for yeast-based natural flavor enhancers and immune health supplements.

6. Competitor Analysis

The competitive landscape is characterized by a mix of global food ingredient giants and biotech innovators:

Key Players: Angel Yeast Co., Kerry Group, Lesaffre, Lallemand, ABF Ingredients, and Biotec Pharmacon.

Strategies: Players are investing in R&D to improve extraction methods, developing premium-grade beta glucans, and expanding into health-conscious emerging markets.

Challenges: High production costs and regulatory complexities may hinder growth.

Opportunities: Expanding use in functional foods, dietary supplements, and chronic disease management offers immense potential.

7. Press Release Conclusion

The Yeast Extracts and Beta Glucan Market is at the forefront of the health-driven transformation in global food and pharma industries. With rising consumer demand for natural, functional, and immune-boosting products, the market is expected to see strong expansion in the coming years. The U.S. and Germany are driving innovation, while Asia-Pacific is emerging as a major growth hub. Companies leveraging biotechnology, sustainable practices, and personalized nutrition trends will be best positioned to lead this evolving market.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Kommentare

0 Anteile

77 Ansichten