Light Detection and Ranging Market to be Driven by increasing population in the Forecast Period of 2025-2032

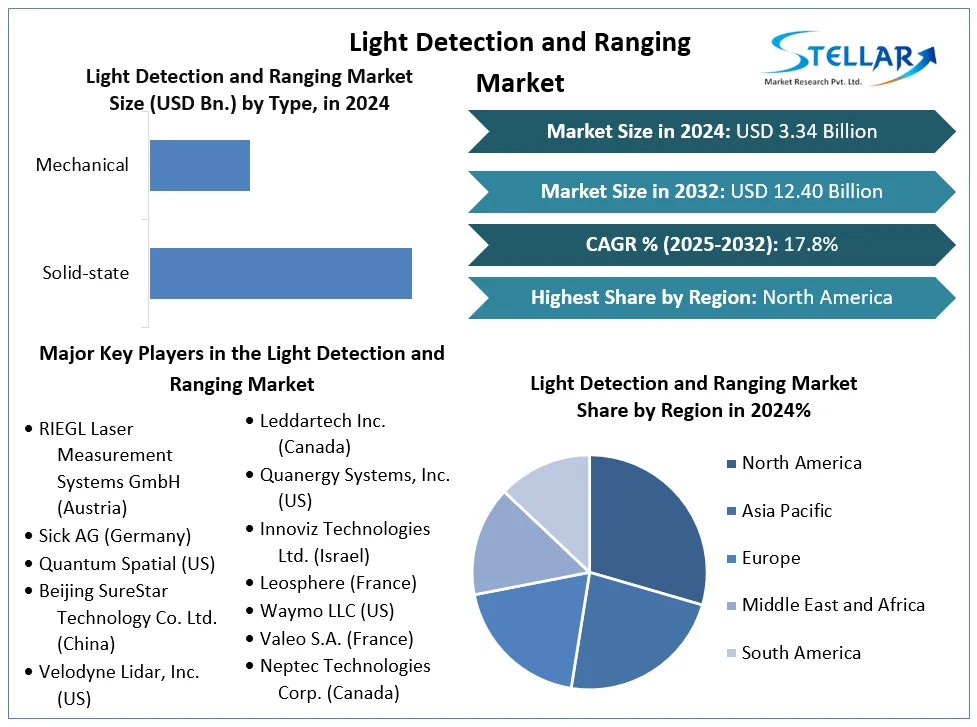

Light Detection and Ranging (LiDAR) Market, valued at around USD 3.34 billion in 2024, is forecast to grow to approximately USD 12.40 billion by 2032, led by a CAGR of about 17.8% . Other projections estimate growth from USD 2.63 billion in 2024 to USD 9.68 billion by 2032 at a 18.2% CAGR These figures reflect rapid expansion supported by rising ADAS uptake in automotive, infrastructure monitoring, robotics, and survey & mapping applications.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Light-Detection-and-Ranging-Market/429

Market Estimation, Growth Drivers & Opportunities

LiDAR uses pulsed laser light to generate high-precision 3D data for mapping, object detection, and navigation. It's commonly integrated into autonomous vehicles, aerial platforms, robotic systems, infrastructure monitoring, and unmanned vehicles.

Growth Drivers:

Autonomous vehicle adoption drives large-scale LiDAR deployment for ADAS and level‑3+ autonomy readiness .

Smart city and traffic systems, using LiDAR to monitor pedestrian flow, manage intersections, and map urban infrastructure.

Industrial automation, robotics, and drone surveying applications continue expanding in logistics, mining, and agriculture .

Hardware innovation: transition from mechanical to solid-state and hybrid LiDAR reduces cost, size, and power consumption—solid-state segment is among the fastest-growing (~22.1% CAGR)

Scale-up in manufacturing, with new plants projected to produce millions of sensors annually by 2025

Opportunities include embedding LiDAR into EVs and robotaxis, installing sensors in infrastructure projects, integrating LiDAR with AI/edge perception stacks, and launching smart-city pilot programs.

U.S. Market: Trends & Investment

North America, led by the U.S., held approximately 38% of automotive LiDAR revenue in 2024, valued at USD 460 million, projected to grow to USD 3.71 billion by 2034 at ~24.8% CAGR

Notable developments:

Automotive investments: notable LiDAR R&D funding in California, Michigan, and Arizona testbeds exceeded USD 90 million in 2023, funded from state and federal sources

Corporate growth: U.S. firm Luminar shipped ~6,000 sensors in Q1 2025, up 50% quarter-over-quarter and projecting 10–20% YoY sales growth

OEM collaborations: Mercedes-Benz signed a development deal with Luminar for its next-gen Halo sensor, to deploy broadly around 2026; Mercedes also sources from Hesai to mitigate supply risk

Infrastructure & robotics applications are emerging, boosting domestic LiDAR demand beyond automotive.

Market Segmentation: Dominant Segment

By Application:

Automotive (ADAS & autonomous vehicles) leads, capturing largest share (>40%) due to adoption of LiDAR-equipped models and robotaxi pilots

Next fastest-growing areas: industrial automation, smart infrastructure, and mapping/drones.

By Technology Type:

Mechanical LiDAR currently holds majority share, favored for range and accuracy.

Solid-state and hybrid LiDAR segments are expanding fastest—due to lower cost, compactness, and reliability

By Range:

Short-range LiDAR (<100 m) held ~45% share in 2024, used in robots, drones, and near-field ADAS.

Medium- and long-range systems are growing for automotive and mapping usage

By End-User:

Automotive OEMs lead (>40%).

Tier-1 suppliers and tech companies growing fastest (~22.5% CAGR) as platforms scale

Competitive Analysis: Top 5 Companies

1. Hesai Technology (China/U.S.)

Dominated robotaxi LiDAR supply in 2023 (~73% share), serves clients like Cruise and Pony.ai. Despite Pentagon blacklisting controversies, it plans its first overseas factory (outside China) by 2026 to mitigate geopolitical risk, and completed its first profitable year in 2024 with expected net profit of up to USD 69 million in 2025

2. Luminar Technologies (USA)

Supplier of high-performance LiDAR (Iris+ and Halo). Merger-driven restructuring led Q1 2025 shipments to jump 50%. Luminar strengthened partnerships with OEMs like Volvo and Mercedes, and is targeting scalable production by 2026 .

3. Aeva, Inc. (USA)

Develops 4D LiDAR-on-chip modules used in autonomous vehicles and robotics. Clients include TuSimple, Deutsche Bahn Cargo, and NASA Artemis missions—Aeva raised over USD 560 million in capital to scale operations .

4. Ouster (USA)

Merged with Velodyne in 2023, creating a mid-market LiDAR powerhouse. Offers digital 3D sensors across automotive, robotics, and industrial sectors, with global presence across 50+ countries

5. RoboSense (China)

Develops LiDAR sensors for ADAS, autonomous mobility, and logistics. Supported by investors including Xiaomi and BYD, it is scaling domestic and international deployments .

Other notable players include Valeo (France), Quanergy, LeddarTech (Canada), Innoviz (Israel), SICK AG, and Leica Geosystems, all innovating in sensor architecture, firmware, and integration.

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Led global automotive LiDAR with ~38% share in 2024. Strong investment in OEM pilots, state-backed testbeds, and domestic suppliers such as Luminar and Aeva

China: Largest regional supplier—Chinese vendors held approx. 65% of LiDAR market in 2024 due to low-cost mass production and EV demand. Hesai and RoboSense dominate locally and expand globally

Germany, UK, France: Key EU markets investing in smart infrastructure and advanced vehicle automation; Valeo (France), Bosch/Continental (Germany), and UK-based innovators collaborating on LiDAR integrations in premium vehicles

Japan: Strong industrial automation adoption and robotics applications; government support for smart-city and logistics deployments.

Conclusion

The LiDAR market is entering an accelerated growth phase—expected to expand from USD 3.3 billion in 2024 to between USD 9.7 billion and USD 12.4 billion by 2032, growing at a 17%–18% CAGR . Expansion is driven by adoption in automotive ADAS/robotaxis, urban mobility infrastructure, robotics, and industrial sensing.

Strategic opportunities include:

Scaling solid-state and hybrid LiDAR production for cost reduction and wide OEM deployment.

Embedding LiDAR in robotaxi fleets, EVs, drones, and infrastructure sensors.

Integrating LiDAR with edge-AI perception platforms and sensor fusion stacks.

Localizing production through overseas manufacturing sites (as pursued by Hesai).

Expanding LiDAR applications into urban planning, obstacle detection, and industrial automation.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Light Detection and Ranging (LiDAR) Market, valued at around USD 3.34 billion in 2024, is forecast to grow to approximately USD 12.40 billion by 2032, led by a CAGR of about 17.8% . Other projections estimate growth from USD 2.63 billion in 2024 to USD 9.68 billion by 2032 at a 18.2% CAGR These figures reflect rapid expansion supported by rising ADAS uptake in automotive, infrastructure monitoring, robotics, and survey & mapping applications.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Light-Detection-and-Ranging-Market/429

Market Estimation, Growth Drivers & Opportunities

LiDAR uses pulsed laser light to generate high-precision 3D data for mapping, object detection, and navigation. It's commonly integrated into autonomous vehicles, aerial platforms, robotic systems, infrastructure monitoring, and unmanned vehicles.

Growth Drivers:

Autonomous vehicle adoption drives large-scale LiDAR deployment for ADAS and level‑3+ autonomy readiness .

Smart city and traffic systems, using LiDAR to monitor pedestrian flow, manage intersections, and map urban infrastructure.

Industrial automation, robotics, and drone surveying applications continue expanding in logistics, mining, and agriculture .

Hardware innovation: transition from mechanical to solid-state and hybrid LiDAR reduces cost, size, and power consumption—solid-state segment is among the fastest-growing (~22.1% CAGR)

Scale-up in manufacturing, with new plants projected to produce millions of sensors annually by 2025

Opportunities include embedding LiDAR into EVs and robotaxis, installing sensors in infrastructure projects, integrating LiDAR with AI/edge perception stacks, and launching smart-city pilot programs.

U.S. Market: Trends & Investment

North America, led by the U.S., held approximately 38% of automotive LiDAR revenue in 2024, valued at USD 460 million, projected to grow to USD 3.71 billion by 2034 at ~24.8% CAGR

Notable developments:

Automotive investments: notable LiDAR R&D funding in California, Michigan, and Arizona testbeds exceeded USD 90 million in 2023, funded from state and federal sources

Corporate growth: U.S. firm Luminar shipped ~6,000 sensors in Q1 2025, up 50% quarter-over-quarter and projecting 10–20% YoY sales growth

OEM collaborations: Mercedes-Benz signed a development deal with Luminar for its next-gen Halo sensor, to deploy broadly around 2026; Mercedes also sources from Hesai to mitigate supply risk

Infrastructure & robotics applications are emerging, boosting domestic LiDAR demand beyond automotive.

Market Segmentation: Dominant Segment

By Application:

Automotive (ADAS & autonomous vehicles) leads, capturing largest share (>40%) due to adoption of LiDAR-equipped models and robotaxi pilots

Next fastest-growing areas: industrial automation, smart infrastructure, and mapping/drones.

By Technology Type:

Mechanical LiDAR currently holds majority share, favored for range and accuracy.

Solid-state and hybrid LiDAR segments are expanding fastest—due to lower cost, compactness, and reliability

By Range:

Short-range LiDAR (<100 m) held ~45% share in 2024, used in robots, drones, and near-field ADAS.

Medium- and long-range systems are growing for automotive and mapping usage

By End-User:

Automotive OEMs lead (>40%).

Tier-1 suppliers and tech companies growing fastest (~22.5% CAGR) as platforms scale

Competitive Analysis: Top 5 Companies

1. Hesai Technology (China/U.S.)

Dominated robotaxi LiDAR supply in 2023 (~73% share), serves clients like Cruise and Pony.ai. Despite Pentagon blacklisting controversies, it plans its first overseas factory (outside China) by 2026 to mitigate geopolitical risk, and completed its first profitable year in 2024 with expected net profit of up to USD 69 million in 2025

2. Luminar Technologies (USA)

Supplier of high-performance LiDAR (Iris+ and Halo). Merger-driven restructuring led Q1 2025 shipments to jump 50%. Luminar strengthened partnerships with OEMs like Volvo and Mercedes, and is targeting scalable production by 2026 .

3. Aeva, Inc. (USA)

Develops 4D LiDAR-on-chip modules used in autonomous vehicles and robotics. Clients include TuSimple, Deutsche Bahn Cargo, and NASA Artemis missions—Aeva raised over USD 560 million in capital to scale operations .

4. Ouster (USA)

Merged with Velodyne in 2023, creating a mid-market LiDAR powerhouse. Offers digital 3D sensors across automotive, robotics, and industrial sectors, with global presence across 50+ countries

5. RoboSense (China)

Develops LiDAR sensors for ADAS, autonomous mobility, and logistics. Supported by investors including Xiaomi and BYD, it is scaling domestic and international deployments .

Other notable players include Valeo (France), Quanergy, LeddarTech (Canada), Innoviz (Israel), SICK AG, and Leica Geosystems, all innovating in sensor architecture, firmware, and integration.

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Led global automotive LiDAR with ~38% share in 2024. Strong investment in OEM pilots, state-backed testbeds, and domestic suppliers such as Luminar and Aeva

China: Largest regional supplier—Chinese vendors held approx. 65% of LiDAR market in 2024 due to low-cost mass production and EV demand. Hesai and RoboSense dominate locally and expand globally

Germany, UK, France: Key EU markets investing in smart infrastructure and advanced vehicle automation; Valeo (France), Bosch/Continental (Germany), and UK-based innovators collaborating on LiDAR integrations in premium vehicles

Japan: Strong industrial automation adoption and robotics applications; government support for smart-city and logistics deployments.

Conclusion

The LiDAR market is entering an accelerated growth phase—expected to expand from USD 3.3 billion in 2024 to between USD 9.7 billion and USD 12.4 billion by 2032, growing at a 17%–18% CAGR . Expansion is driven by adoption in automotive ADAS/robotaxis, urban mobility infrastructure, robotics, and industrial sensing.

Strategic opportunities include:

Scaling solid-state and hybrid LiDAR production for cost reduction and wide OEM deployment.

Embedding LiDAR in robotaxi fleets, EVs, drones, and infrastructure sensors.

Integrating LiDAR with edge-AI perception platforms and sensor fusion stacks.

Localizing production through overseas manufacturing sites (as pursued by Hesai).

Expanding LiDAR applications into urban planning, obstacle detection, and industrial automation.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

Light Detection and Ranging Market to be Driven by increasing population in the Forecast Period of 2025-2032

Light Detection and Ranging (LiDAR) Market, valued at around USD 3.34 billion in 2024, is forecast to grow to approximately USD 12.40 billion by 2032, led by a CAGR of about 17.8% . Other projections estimate growth from USD 2.63 billion in 2024 to USD 9.68 billion by 2032 at a 18.2% CAGR These figures reflect rapid expansion supported by rising ADAS uptake in automotive, infrastructure monitoring, robotics, and survey & mapping applications.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Light-Detection-and-Ranging-Market/429

Market Estimation, Growth Drivers & Opportunities

LiDAR uses pulsed laser light to generate high-precision 3D data for mapping, object detection, and navigation. It's commonly integrated into autonomous vehicles, aerial platforms, robotic systems, infrastructure monitoring, and unmanned vehicles.

Growth Drivers:

Autonomous vehicle adoption drives large-scale LiDAR deployment for ADAS and level‑3+ autonomy readiness .

Smart city and traffic systems, using LiDAR to monitor pedestrian flow, manage intersections, and map urban infrastructure.

Industrial automation, robotics, and drone surveying applications continue expanding in logistics, mining, and agriculture .

Hardware innovation: transition from mechanical to solid-state and hybrid LiDAR reduces cost, size, and power consumption—solid-state segment is among the fastest-growing (~22.1% CAGR)

Scale-up in manufacturing, with new plants projected to produce millions of sensors annually by 2025

Opportunities include embedding LiDAR into EVs and robotaxis, installing sensors in infrastructure projects, integrating LiDAR with AI/edge perception stacks, and launching smart-city pilot programs.

U.S. Market: Trends & Investment

North America, led by the U.S., held approximately 38% of automotive LiDAR revenue in 2024, valued at USD 460 million, projected to grow to USD 3.71 billion by 2034 at ~24.8% CAGR

Notable developments:

Automotive investments: notable LiDAR R&D funding in California, Michigan, and Arizona testbeds exceeded USD 90 million in 2023, funded from state and federal sources

Corporate growth: U.S. firm Luminar shipped ~6,000 sensors in Q1 2025, up 50% quarter-over-quarter and projecting 10–20% YoY sales growth

OEM collaborations: Mercedes-Benz signed a development deal with Luminar for its next-gen Halo sensor, to deploy broadly around 2026; Mercedes also sources from Hesai to mitigate supply risk

Infrastructure & robotics applications are emerging, boosting domestic LiDAR demand beyond automotive.

Market Segmentation: Dominant Segment

By Application:

Automotive (ADAS & autonomous vehicles) leads, capturing largest share (>40%) due to adoption of LiDAR-equipped models and robotaxi pilots

Next fastest-growing areas: industrial automation, smart infrastructure, and mapping/drones.

By Technology Type:

Mechanical LiDAR currently holds majority share, favored for range and accuracy.

Solid-state and hybrid LiDAR segments are expanding fastest—due to lower cost, compactness, and reliability

By Range:

Short-range LiDAR (<100 m) held ~45% share in 2024, used in robots, drones, and near-field ADAS.

Medium- and long-range systems are growing for automotive and mapping usage

By End-User:

Automotive OEMs lead (>40%).

Tier-1 suppliers and tech companies growing fastest (~22.5% CAGR) as platforms scale

Competitive Analysis: Top 5 Companies

1. Hesai Technology (China/U.S.)

Dominated robotaxi LiDAR supply in 2023 (~73% share), serves clients like Cruise and Pony.ai. Despite Pentagon blacklisting controversies, it plans its first overseas factory (outside China) by 2026 to mitigate geopolitical risk, and completed its first profitable year in 2024 with expected net profit of up to USD 69 million in 2025

2. Luminar Technologies (USA)

Supplier of high-performance LiDAR (Iris+ and Halo). Merger-driven restructuring led Q1 2025 shipments to jump 50%. Luminar strengthened partnerships with OEMs like Volvo and Mercedes, and is targeting scalable production by 2026 .

3. Aeva, Inc. (USA)

Develops 4D LiDAR-on-chip modules used in autonomous vehicles and robotics. Clients include TuSimple, Deutsche Bahn Cargo, and NASA Artemis missions—Aeva raised over USD 560 million in capital to scale operations .

4. Ouster (USA)

Merged with Velodyne in 2023, creating a mid-market LiDAR powerhouse. Offers digital 3D sensors across automotive, robotics, and industrial sectors, with global presence across 50+ countries

5. RoboSense (China)

Develops LiDAR sensors for ADAS, autonomous mobility, and logistics. Supported by investors including Xiaomi and BYD, it is scaling domestic and international deployments .

Other notable players include Valeo (France), Quanergy, LeddarTech (Canada), Innoviz (Israel), SICK AG, and Leica Geosystems, all innovating in sensor architecture, firmware, and integration.

Regional Analysis: USA, UK, Germany, France, Japan & China

United States: Led global automotive LiDAR with ~38% share in 2024. Strong investment in OEM pilots, state-backed testbeds, and domestic suppliers such as Luminar and Aeva

China: Largest regional supplier—Chinese vendors held approx. 65% of LiDAR market in 2024 due to low-cost mass production and EV demand. Hesai and RoboSense dominate locally and expand globally

Germany, UK, France: Key EU markets investing in smart infrastructure and advanced vehicle automation; Valeo (France), Bosch/Continental (Germany), and UK-based innovators collaborating on LiDAR integrations in premium vehicles

Japan: Strong industrial automation adoption and robotics applications; government support for smart-city and logistics deployments.

Conclusion

The LiDAR market is entering an accelerated growth phase—expected to expand from USD 3.3 billion in 2024 to between USD 9.7 billion and USD 12.4 billion by 2032, growing at a 17%–18% CAGR . Expansion is driven by adoption in automotive ADAS/robotaxis, urban mobility infrastructure, robotics, and industrial sensing.

Strategic opportunities include:

Scaling solid-state and hybrid LiDAR production for cost reduction and wide OEM deployment.

Embedding LiDAR in robotaxi fleets, EVs, drones, and infrastructure sensors.

Integrating LiDAR with edge-AI perception platforms and sensor fusion stacks.

Localizing production through overseas manufacturing sites (as pursued by Hesai).

Expanding LiDAR applications into urban planning, obstacle detection, and industrial automation.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]

0 Comments

0 Shares

426 Views