Fluoropolymers Market to be Driven by increasing population in the Forecast Period of 2025-2032

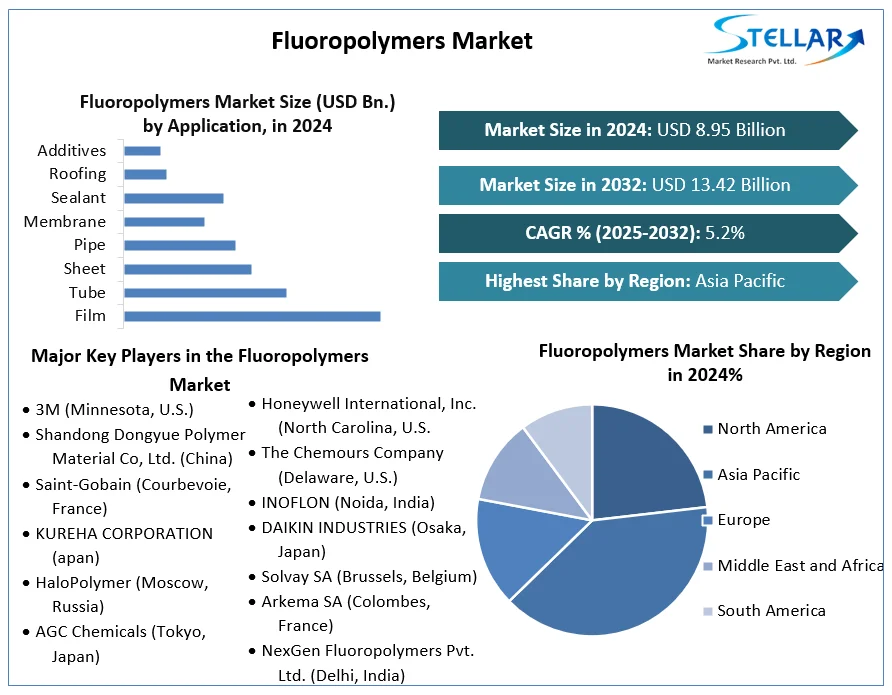

Fluoropolymers Market, valued at USD 8.63 billion in 2023, is projected to reach USD 13.12 billion by 2030, growing at a CAGR of 6.2% during the forecast period. The surge in demand is being fueled by the increasing use of fluoropolymers in high-performance applications across electronics, automotive, chemical processing, renewable energy, and healthcare industries.

Request Free Sample Report:

https://www.stellarmr.com/report/req_sample/Fluoropolymers-Market/936

Market Estimation, Growth Drivers & Opportunities

Fluoropolymers are high-performance synthetic polymers characterized by their exceptional thermal stability, chemical resistance, low friction, and electrical insulation properties. These attributes make them indispensable in harsh operating environments.

Key Growth Drivers:

Surge in Electronics Manufacturing: Fluoropolymers are widely used in semiconductors, wire insulation, and flexible printed circuit boards due to their superior dielectric properties and heat resistance.

Expansion in EV and Automotive Sector: Fluoropolymers enable lightweight, high-durability components in EV battery systems, fuel lines, and gaskets, contributing to vehicle efficiency and regulatory compliance.

Chemical Processing Industry: Fluoropolymers such as PTFE and FEP are used in piping, seals, and coatings for corrosion-prone environments.

Growing Renewable Energy Sector: Use in photovoltaic modules and hydrogen fuel cells is expanding fluoropolymer applications in sustainable energy solutions.

Opportunities:

Rising demand for low-friction, non-stick coatings in cookware and industrial equipment.

Increased use in medical devices, especially catheters and tubing, due to biocompatibility and sterilization resistance.

Regulatory support for low-emission vehicles and clean energy technologies, increasing fluoropolymer adoption.

U.S. Market Trends & Investment (2024 Developments)

In 2024, the U.S. market saw a surge in fluoropolymer demand due to a sharp rise in semiconductor fabrication investments and federal backing for electric vehicle infrastructure. The CHIPS and Science Act and the Inflation Reduction Act have directed billions into clean technology and high-tech manufacturing, spurring demand for fluoropolymer-based components.

Major players like Chemours and 3M have committed to phasing out legacy PFAS materials and developing next-generation fluoropolymers with reduced environmental impact. In April 2024, Chemours announced an $80 million investment in a new PTFE and PFA compounding facility to serve North American electronics and automotive markets. Meanwhile, U.S. startups are innovating with fluoropolymer recycling and circular economy models.

Market Segmentation – Leading Segment Analysis

The Fluoropolymers Market is segmented by Type, End-User, and Region. Among these:

By Type, Polytetrafluoroethylene (PTFE) holds the largest market share due to its high demand across diverse applications like wiring insulation, gaskets, non-stick coatings, and industrial linings.

By End-User, the Electrical & Electronics segment dominates due to the extensive use of PTFE, FEP, and ETFE in high-frequency cables, semiconductor components, and thermal insulation systems. With the expansion of AI, 5G, and consumer electronics, this dominance is expected to continue.

Competitive Analysis – Top 5 Global Leaders

The fluoropolymers market is moderately consolidated with key global players holding significant shares through technological innovation, vertical integration, and material advancements.

The Chemours Company (USA)

A spin-off of DuPont, Chemours leads in PTFE (Teflon™) and perfluoroelastomers. In 2024, it accelerated the shift to PFAS alternatives, investing in eco-friendly fluoropolymers and expanding production capacity in Ohio and Mexico. Their innovation in low-GWP (Global Warming Potential) materials is driving demand in EVs and HVAC systems.

3M Company (USA)

3M has historically been a major PFAS supplier but recently announced its exit from PFAS manufacturing by 2025. However, the company is pivoting towards fluoropolymer applications in medical, filtration, and microelectronics, focusing on sustainable product lines and R&D in advanced composites.

Daikin Industries Ltd. (Japan)

Daikin is one of the largest producers of fluoro-based resins including FEP and PFA. The company is actively investing in high-performance materials for hydrogen storage, fuel cells, and semiconductors, particularly in Asia and Europe.

Arkema Group (France)

Arkema manufactures Kynar® PVDF fluoropolymers and has gained significant traction in lithium-ion batteries, solar panels, and water filtration systems. In 2024, Arkema expanded its facility in Changshu, China, to meet growing global demand for PVDF in battery separators.

Solvay S.A. (Belgium)

Solvay offers a wide portfolio of specialty fluoropolymers and is known for its Solef® PVDF. The company is focusing on sustainable mobility and electronics. In Q2 2024, it launched new PVDF grades with enhanced dielectric properties to support next-gen semiconductor packaging.

These companies are aligned with global trends of environmental regulation, innovation in sustainable materials, and increased localization of supply chains.

Regional Insights – Focus on USA, UK, Germany, France, Japan, and China

USA: Holds a major share of the North American market driven by semiconductor, defense, and electric vehicle sectors. Government incentives and a shift to non-PFAS fluoropolymers are key growth levers.

UK: The UK fluoropolymer market is influenced by strict chemical safety regulations and demand from aerospace and electronics industries. Growth is supported by strong R&D activity and emphasis on low-emission materials.

Germany: Europe’s manufacturing hub, Germany leads in the use of fluoropolymers in automotive and industrial applications. Companies are benefiting from the transition to hydrogen energy and EVs, where fluoropolymers play a critical role in system integrity and insulation.

France: A key contributor to the European market, France is emphasizing circular economy frameworks and sustainable production. Arkema’s innovations and government backing of battery manufacturing are enhancing domestic demand.

Japan: Japan is investing in advanced battery technology and high-tech materials. Companies like Daikin and AGC are developing next-gen fluoropolymers for AI and IoT devices, sustaining Japan’s global leadership in electronics.

China: The world’s largest manufacturer and consumer of fluoropolymers. Government focus on solar energy, electric vehicles, and semiconductors is boosting demand. China is also rapidly scaling PVDF and ETFE production, catering to both domestic and export markets.

Conclusion

The global fluoropolymers market is on an upward trajectory, driven by the convergence of technological innovation, environmental regulation, and rising demand from clean energy, electronics, and automotive sectors. As the industry transitions away from harmful PFAS-based chemistries, there is a significant opportunity for next-gen, sustainable fluoropolymers to redefine market standards.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Fluoropolymers Market to be Driven by increasing population in the Forecast Period of 2025-2032

Fluoropolymers Market, valued at USD 8.63 billion in 2023, is projected to reach USD 13.12 billion by 2030, growing at a CAGR of 6.2% during the forecast period. The surge in demand is being fueled by the increasing use of fluoropolymers in high-performance applications across electronics, automotive, chemical processing, renewable energy, and healthcare industries.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Fluoropolymers-Market/936

Market Estimation, Growth Drivers & Opportunities

Fluoropolymers are high-performance synthetic polymers characterized by their exceptional thermal stability, chemical resistance, low friction, and electrical insulation properties. These attributes make them indispensable in harsh operating environments.

Key Growth Drivers:

Surge in Electronics Manufacturing: Fluoropolymers are widely used in semiconductors, wire insulation, and flexible printed circuit boards due to their superior dielectric properties and heat resistance.

Expansion in EV and Automotive Sector: Fluoropolymers enable lightweight, high-durability components in EV battery systems, fuel lines, and gaskets, contributing to vehicle efficiency and regulatory compliance.

Chemical Processing Industry: Fluoropolymers such as PTFE and FEP are used in piping, seals, and coatings for corrosion-prone environments.

Growing Renewable Energy Sector: Use in photovoltaic modules and hydrogen fuel cells is expanding fluoropolymer applications in sustainable energy solutions.

Opportunities:

Rising demand for low-friction, non-stick coatings in cookware and industrial equipment.

Increased use in medical devices, especially catheters and tubing, due to biocompatibility and sterilization resistance.

Regulatory support for low-emission vehicles and clean energy technologies, increasing fluoropolymer adoption.

U.S. Market Trends & Investment (2024 Developments)

In 2024, the U.S. market saw a surge in fluoropolymer demand due to a sharp rise in semiconductor fabrication investments and federal backing for electric vehicle infrastructure. The CHIPS and Science Act and the Inflation Reduction Act have directed billions into clean technology and high-tech manufacturing, spurring demand for fluoropolymer-based components.

Major players like Chemours and 3M have committed to phasing out legacy PFAS materials and developing next-generation fluoropolymers with reduced environmental impact. In April 2024, Chemours announced an $80 million investment in a new PTFE and PFA compounding facility to serve North American electronics and automotive markets. Meanwhile, U.S. startups are innovating with fluoropolymer recycling and circular economy models.

Market Segmentation – Leading Segment Analysis

The Fluoropolymers Market is segmented by Type, End-User, and Region. Among these:

By Type, Polytetrafluoroethylene (PTFE) holds the largest market share due to its high demand across diverse applications like wiring insulation, gaskets, non-stick coatings, and industrial linings.

By End-User, the Electrical & Electronics segment dominates due to the extensive use of PTFE, FEP, and ETFE in high-frequency cables, semiconductor components, and thermal insulation systems. With the expansion of AI, 5G, and consumer electronics, this dominance is expected to continue.

Competitive Analysis – Top 5 Global Leaders

The fluoropolymers market is moderately consolidated with key global players holding significant shares through technological innovation, vertical integration, and material advancements.

The Chemours Company (USA)

A spin-off of DuPont, Chemours leads in PTFE (Teflon™) and perfluoroelastomers. In 2024, it accelerated the shift to PFAS alternatives, investing in eco-friendly fluoropolymers and expanding production capacity in Ohio and Mexico. Their innovation in low-GWP (Global Warming Potential) materials is driving demand in EVs and HVAC systems.

3M Company (USA)

3M has historically been a major PFAS supplier but recently announced its exit from PFAS manufacturing by 2025. However, the company is pivoting towards fluoropolymer applications in medical, filtration, and microelectronics, focusing on sustainable product lines and R&D in advanced composites.

Daikin Industries Ltd. (Japan)

Daikin is one of the largest producers of fluoro-based resins including FEP and PFA. The company is actively investing in high-performance materials for hydrogen storage, fuel cells, and semiconductors, particularly in Asia and Europe.

Arkema Group (France)

Arkema manufactures Kynar® PVDF fluoropolymers and has gained significant traction in lithium-ion batteries, solar panels, and water filtration systems. In 2024, Arkema expanded its facility in Changshu, China, to meet growing global demand for PVDF in battery separators.

Solvay S.A. (Belgium)

Solvay offers a wide portfolio of specialty fluoropolymers and is known for its Solef® PVDF. The company is focusing on sustainable mobility and electronics. In Q2 2024, it launched new PVDF grades with enhanced dielectric properties to support next-gen semiconductor packaging.

These companies are aligned with global trends of environmental regulation, innovation in sustainable materials, and increased localization of supply chains.

Regional Insights – Focus on USA, UK, Germany, France, Japan, and China

USA: Holds a major share of the North American market driven by semiconductor, defense, and electric vehicle sectors. Government incentives and a shift to non-PFAS fluoropolymers are key growth levers.

UK: The UK fluoropolymer market is influenced by strict chemical safety regulations and demand from aerospace and electronics industries. Growth is supported by strong R&D activity and emphasis on low-emission materials.

Germany: Europe’s manufacturing hub, Germany leads in the use of fluoropolymers in automotive and industrial applications. Companies are benefiting from the transition to hydrogen energy and EVs, where fluoropolymers play a critical role in system integrity and insulation.

France: A key contributor to the European market, France is emphasizing circular economy frameworks and sustainable production. Arkema’s innovations and government backing of battery manufacturing are enhancing domestic demand.

Japan: Japan is investing in advanced battery technology and high-tech materials. Companies like Daikin and AGC are developing next-gen fluoropolymers for AI and IoT devices, sustaining Japan’s global leadership in electronics.

China: The world’s largest manufacturer and consumer of fluoropolymers. Government focus on solar energy, electric vehicles, and semiconductors is boosting demand. China is also rapidly scaling PVDF and ETFE production, catering to both domestic and export markets.

Conclusion

The global fluoropolymers market is on an upward trajectory, driven by the convergence of technological innovation, environmental regulation, and rising demand from clean energy, electronics, and automotive sectors. As the industry transitions away from harmful PFAS-based chemistries, there is a significant opportunity for next-gen, sustainable fluoropolymers to redefine market standards.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]