Intramedullary Nails Market Size to Grow at a CAGR 6.0 %

Intramedullary Nails Market Poised for Robust Growth – A Comprehensive Analysis

Market Estimation & Definition

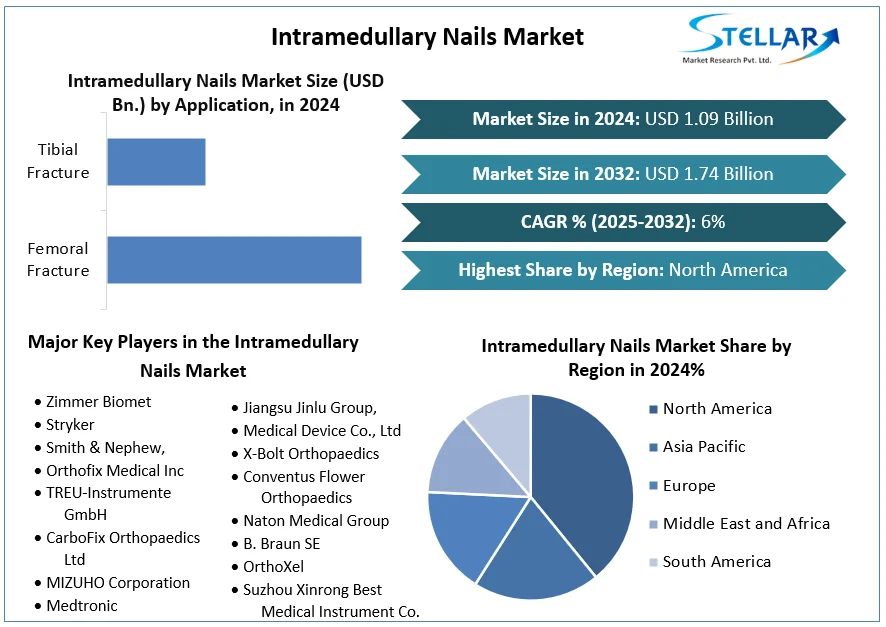

The global intramedullary nails market was valued at approximately USD 736.47 million in 2024 and is projected to reach USD 1.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.58% during the forecast period from 2025 to 2034.

Intramedullary nails, also known as intramedullary rods or IM nails, are surgical implants used in orthopedic procedures to stabilize fractures of long bones, particularly in the femur, tibia, and humerus. These metal rods are inserted into the medullary canal (the central cavity) of the bone, providing internal fixation to align and stabilize fractured bones during the healing process.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/intramedullary-nails-market/2469

Market Growth Drivers & Opportunities

Several factors are contributing to the rapid growth of the intramedullary nails market:

Increasing Incidence of Bone Fractures: The rising number of bone fractures, particularly among the aging population and due to sports-related injuries, is driving the demand for effective fixation solutions.

Advancements in Surgical Techniques: The shift towards minimally invasive surgical techniques has increased the adoption of intramedullary nails, as they require smaller incisions, leading to reduced recovery times and lower risk of complications.

Technological Innovations: Developments in nail designs, materials, and locking mechanisms have enhanced the effectiveness and safety of intramedullary nails, further propelling market growth.

Rising Healthcare Access in Emerging Markets: Increasing healthcare infrastructure and access in emerging economies are expanding the market for intramedullary nails.

What Lies Ahead: Emerging Trends Shaping the Future

The intramedullary nails market is witnessing several emerging trends:

Personalized Orthopedic Solutions: Advances in patient-specific implants and 3D printing technologies are enabling the development of customized intramedullary nails tailored to individual patient anatomies.

Bioabsorbable Materials: Research into bioabsorbable intramedullary nails is underway, aiming to eliminate the need for removal surgeries and reduce long-term complications.

Integration of Smart Technologies: The incorporation of sensors and monitoring devices into intramedullary nails is being explored to provide real-time data on bone healing and implant performance.

Focus on Pediatric Applications: The development of pediatric-specific intramedullary nails is gaining attention to address the unique needs of growing children with bone fractures.

Segmentation Analysis

The intramedullary nails market can be segmented based on type, material, application, and end user:

By Type:

Long Gamma Nail (LGN)

Trochanteric Femoral Nail (TFN)

Intertroch/Subtroch Nail (ITST)

Other Types (Antegrade, Retrograde, Tibial, Femoral)

By Material:

Titanium Alloys

Stainless Steel

By Application:

Femoral Fracture

Tibial Fracture

Other Applications

By End User:

Hospitals

Ambulatory Surgical Centers

Specialty and Orthopedic Clinics

Other End Users

Country-Level Analysis

United States: The U.S. holds a significant share of the intramedullary nails market, driven by advanced healthcare infrastructure, a high incidence of bone fractures, and a preference for minimally invasive surgical techniques.

Germany: Germany's strong healthcare system and emphasis on orthopedic care contribute to its prominence in the European market.

China: China's rapidly growing healthcare sector and increasing prevalence of bone fractures are propelling the demand for intramedullary nails.

India: In India, the expanding healthcare infrastructure and rising awareness about orthopedic treatments are driving market growth.

Competitive Analysis

The intramedullary nails market is highly competitive, with several key players:

Johnson & Johnson

Medtronic plc

Stryker Corporation

B. Braun Melsungen AG

Zimmer Biomet Holdings Inc.

Smith & Nephew plc

Integra LifeSciences Holdings Corporation

NuVasive Inc.

Globus Medical Inc.

Wright Medical Group N.V.

These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their position in the intramedullary nails market.

Press Release Conclusion

The intramedullary nails market is on a trajectory of significant growth, driven by technological advancements, increasing incidence of bone fractures, and a shift towards minimally invasive surgical techniques. As the market continues to evolve, companies that invest in innovation and understand regional market dynamics will be well-positioned to capitalize on emerging opportunities. The future of intramedullary nails looks promising, with continued advancements and widespread adoption on the horizon.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Intramedullary Nails Market Poised for Robust Growth – A Comprehensive Analysis

Market Estimation & Definition

The global intramedullary nails market was valued at approximately USD 736.47 million in 2024 and is projected to reach USD 1.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.58% during the forecast period from 2025 to 2034.

Intramedullary nails, also known as intramedullary rods or IM nails, are surgical implants used in orthopedic procedures to stabilize fractures of long bones, particularly in the femur, tibia, and humerus. These metal rods are inserted into the medullary canal (the central cavity) of the bone, providing internal fixation to align and stabilize fractured bones during the healing process.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/intramedullary-nails-market/2469

Market Growth Drivers & Opportunities

Several factors are contributing to the rapid growth of the intramedullary nails market:

Increasing Incidence of Bone Fractures: The rising number of bone fractures, particularly among the aging population and due to sports-related injuries, is driving the demand for effective fixation solutions.

Advancements in Surgical Techniques: The shift towards minimally invasive surgical techniques has increased the adoption of intramedullary nails, as they require smaller incisions, leading to reduced recovery times and lower risk of complications.

Technological Innovations: Developments in nail designs, materials, and locking mechanisms have enhanced the effectiveness and safety of intramedullary nails, further propelling market growth.

Rising Healthcare Access in Emerging Markets: Increasing healthcare infrastructure and access in emerging economies are expanding the market for intramedullary nails.

What Lies Ahead: Emerging Trends Shaping the Future

The intramedullary nails market is witnessing several emerging trends:

Personalized Orthopedic Solutions: Advances in patient-specific implants and 3D printing technologies are enabling the development of customized intramedullary nails tailored to individual patient anatomies.

Bioabsorbable Materials: Research into bioabsorbable intramedullary nails is underway, aiming to eliminate the need for removal surgeries and reduce long-term complications.

Integration of Smart Technologies: The incorporation of sensors and monitoring devices into intramedullary nails is being explored to provide real-time data on bone healing and implant performance.

Focus on Pediatric Applications: The development of pediatric-specific intramedullary nails is gaining attention to address the unique needs of growing children with bone fractures.

Segmentation Analysis

The intramedullary nails market can be segmented based on type, material, application, and end user:

By Type:

Long Gamma Nail (LGN)

Trochanteric Femoral Nail (TFN)

Intertroch/Subtroch Nail (ITST)

Other Types (Antegrade, Retrograde, Tibial, Femoral)

By Material:

Titanium Alloys

Stainless Steel

By Application:

Femoral Fracture

Tibial Fracture

Other Applications

By End User:

Hospitals

Ambulatory Surgical Centers

Specialty and Orthopedic Clinics

Other End Users

Country-Level Analysis

United States: The U.S. holds a significant share of the intramedullary nails market, driven by advanced healthcare infrastructure, a high incidence of bone fractures, and a preference for minimally invasive surgical techniques.

Germany: Germany's strong healthcare system and emphasis on orthopedic care contribute to its prominence in the European market.

China: China's rapidly growing healthcare sector and increasing prevalence of bone fractures are propelling the demand for intramedullary nails.

India: In India, the expanding healthcare infrastructure and rising awareness about orthopedic treatments are driving market growth.

Competitive Analysis

The intramedullary nails market is highly competitive, with several key players:

Johnson & Johnson

Medtronic plc

Stryker Corporation

B. Braun Melsungen AG

Zimmer Biomet Holdings Inc.

Smith & Nephew plc

Integra LifeSciences Holdings Corporation

NuVasive Inc.

Globus Medical Inc.

Wright Medical Group N.V.

These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their position in the intramedullary nails market.

Press Release Conclusion

The intramedullary nails market is on a trajectory of significant growth, driven by technological advancements, increasing incidence of bone fractures, and a shift towards minimally invasive surgical techniques. As the market continues to evolve, companies that invest in innovation and understand regional market dynamics will be well-positioned to capitalize on emerging opportunities. The future of intramedullary nails looks promising, with continued advancements and widespread adoption on the horizon.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Intramedullary Nails Market Size to Grow at a CAGR 6.0 %

Intramedullary Nails Market Poised for Robust Growth – A Comprehensive Analysis

Market Estimation & Definition

The global intramedullary nails market was valued at approximately USD 736.47 million in 2024 and is projected to reach USD 1.39 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.58% during the forecast period from 2025 to 2034.

Intramedullary nails, also known as intramedullary rods or IM nails, are surgical implants used in orthopedic procedures to stabilize fractures of long bones, particularly in the femur, tibia, and humerus. These metal rods are inserted into the medullary canal (the central cavity) of the bone, providing internal fixation to align and stabilize fractured bones during the healing process.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/intramedullary-nails-market/2469

Market Growth Drivers & Opportunities

Several factors are contributing to the rapid growth of the intramedullary nails market:

Increasing Incidence of Bone Fractures: The rising number of bone fractures, particularly among the aging population and due to sports-related injuries, is driving the demand for effective fixation solutions.

Advancements in Surgical Techniques: The shift towards minimally invasive surgical techniques has increased the adoption of intramedullary nails, as they require smaller incisions, leading to reduced recovery times and lower risk of complications.

Technological Innovations: Developments in nail designs, materials, and locking mechanisms have enhanced the effectiveness and safety of intramedullary nails, further propelling market growth.

Rising Healthcare Access in Emerging Markets: Increasing healthcare infrastructure and access in emerging economies are expanding the market for intramedullary nails.

What Lies Ahead: Emerging Trends Shaping the Future

The intramedullary nails market is witnessing several emerging trends:

Personalized Orthopedic Solutions: Advances in patient-specific implants and 3D printing technologies are enabling the development of customized intramedullary nails tailored to individual patient anatomies.

Bioabsorbable Materials: Research into bioabsorbable intramedullary nails is underway, aiming to eliminate the need for removal surgeries and reduce long-term complications.

Integration of Smart Technologies: The incorporation of sensors and monitoring devices into intramedullary nails is being explored to provide real-time data on bone healing and implant performance.

Focus on Pediatric Applications: The development of pediatric-specific intramedullary nails is gaining attention to address the unique needs of growing children with bone fractures.

Segmentation Analysis

The intramedullary nails market can be segmented based on type, material, application, and end user:

By Type:

Long Gamma Nail (LGN)

Trochanteric Femoral Nail (TFN)

Intertroch/Subtroch Nail (ITST)

Other Types (Antegrade, Retrograde, Tibial, Femoral)

By Material:

Titanium Alloys

Stainless Steel

By Application:

Femoral Fracture

Tibial Fracture

Other Applications

By End User:

Hospitals

Ambulatory Surgical Centers

Specialty and Orthopedic Clinics

Other End Users

Country-Level Analysis

United States: The U.S. holds a significant share of the intramedullary nails market, driven by advanced healthcare infrastructure, a high incidence of bone fractures, and a preference for minimally invasive surgical techniques.

Germany: Germany's strong healthcare system and emphasis on orthopedic care contribute to its prominence in the European market.

China: China's rapidly growing healthcare sector and increasing prevalence of bone fractures are propelling the demand for intramedullary nails.

India: In India, the expanding healthcare infrastructure and rising awareness about orthopedic treatments are driving market growth.

Competitive Analysis

The intramedullary nails market is highly competitive, with several key players:

Johnson & Johnson

Medtronic plc

Stryker Corporation

B. Braun Melsungen AG

Zimmer Biomet Holdings Inc.

Smith & Nephew plc

Integra LifeSciences Holdings Corporation

NuVasive Inc.

Globus Medical Inc.

Wright Medical Group N.V.

These companies are focusing on product innovation, strategic partnerships, and expanding their market presence to strengthen their position in the intramedullary nails market.

Press Release Conclusion

The intramedullary nails market is on a trajectory of significant growth, driven by technological advancements, increasing incidence of bone fractures, and a shift towards minimally invasive surgical techniques. As the market continues to evolve, companies that invest in innovation and understand regional market dynamics will be well-positioned to capitalize on emerging opportunities. The future of intramedullary nails looks promising, with continued advancements and widespread adoption on the horizon.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Comentários

0 Compartilhamentos

32 Visualizações