Energy Storage Market to be Driven by increasing population in the Forecast Period of 2025-2032

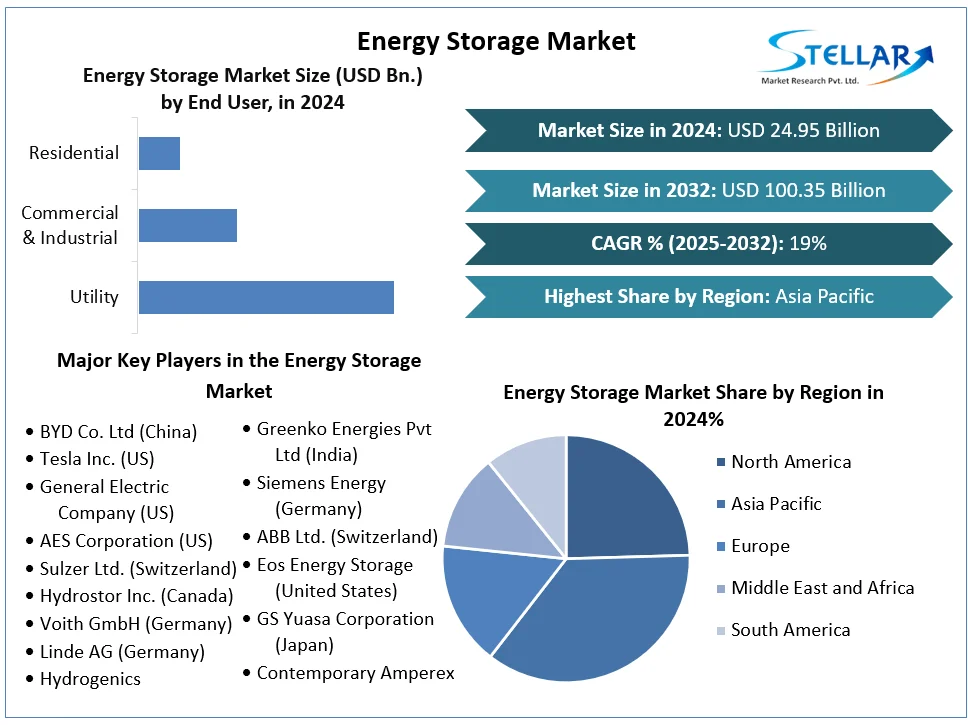

global energy storage market encompasses technologies and solutions that capture energy for later use, enabling grid stability, renewable integration, and energy resilience. Valued at $668.7 billion in 2024, the market is projected to reach $5.12 trillion by 2034, growing at a 21.7% CAGR 3. This includes:

Request Free Sample report:

https://www.stellarmr.com/report/req_sample/Energy-Storage-Market/291

Technologies: Lithium-ion batteries, pumped hydro storage (PHS), thermal storage, and emerging solutions like gravity-based systems.

Applications: Grid stabilization, electric vehicles (EVs), residential backup, and industrial energy management.

The market's expansion is driven by decarbonization goals, renewable energy growth, and technological innovation.

Key Growth Drivers and Opportunities

Primary Catalysts:

Renewable Energy Integration: With 3,870 GW of global renewable capacity (86% of new additions in 2023), storage mitigates intermittency issues in solar/wind power 57.

EV Boom: 13.5 million EVs sold in 2023 (34% YoY growth), driving demand for high-density lithium-ion batteries 37.

Grid Modernization: Surging energy demand and extreme weather events necessitate storage for grid resilience. For example, Entergy (Louisiana) raised electricity rates after hurricanes, highlighting reliability needs 5.

Policy Support: The US Inflation Reduction Act (IRA) offers 30% tax credits for residential storage, while the EU’s Renewable Energy Directive targets 45% renewable energy by 2030 59.

Emerging Opportunities:

AI-Optimized Storage: Machine learning enhances battery performance and safety through real-time monitoring 3.

Second-Life Batteries: Repurposing EV batteries for grid storage reduces costs by 30–50% 3.

Green Technologies: Gravity storage (e.g., sand-based systems) and green hydrogen offer sustainable alternatives 35.

Emerging Markets: The Middle East and Africa project 381% YoY growth in 2025, led by Saudi Arabia and UAE 8.

Market Segmentation Analysis

By Technology:

Lithium-Ion Batteries: Dominates due to EV demand; holds >90% share in utility-scale projects 48.

Pumped Hydro Storage (PHS): Accounts for 35% market share; ideal for long-duration storage (e.g., Greenko’s 3.3 GW project in India) 37.

Emerging Solutions:

Sodium-ion batteries gain traction (e.g., China’s 2024 deployment).

Flow batteries for grid-scale applications 9.

By Application:

Utility-Scale: Largest segment (56% revenue share), driven by renewable firming (e.g., ENGIE’s 638 MWh project in Chile) 5.

Residential: Fastest-growing segment (18.7% CAGR), fueled by solar adoption and power outage concerns 57.

Commercial & Industrial (C&I): Uses storage for peak shaving and demand charge reductio

Competitive Landscape

Top Players: BYD, Samsung SDI, Tesla, LG Energy Solution, and Siemens control >40% market share 35.

BYD: Leads with Blade Battery tech; Q3 2024 revenue of $27.7 billion 3.

Siemens: Focuses on hydrogen storage and CAES; partnered for Texas CAES project 5.

Strategies:

Vertical Integration: CATL mass-produces solid-state batteries to cut costs 3.

Strategic Acquisitions: GridStor acquired 150 MW Texas project (2025) 3.

Regional Expansion: Chinese firms (e.g., Sungrow) dominate Middle East tenders via low bids 8.

Key Challenges

Policy Uncertainty: US tariffs on Chinese imports may raise system costs by 30%, risking 27% reduction in storage buildout 104.

Raw Material Volatility: Lithium price fluctuations threaten supply chains; EU promotes recycling via Battery Directive 9.

Environmental Impact: Battery production causes habitat destruction; recycling infrastructure remains underdeveloped 5.

Future Outlook (2025–2030)

Technology Shifts: Solid-state and sodium-ion batteries to capture 15% market share by 2030 9.

Global Targets: COP29 pledge to reach 1,500 GW storage by 2030 (6x 2022 levels) 9.

Capacity Growth: Annual additions to hit 220 GW/972 GWh by 2035, led by utility-scale projects 48.

AI Integration: Predictive maintenance and autonomous grid management to become standard

Conclusion

The energy storage market is pivotal to the global energy transition, driven by renewable integration, EV expansion, and grid resilience needs. While Asia-Pacific dominates and emerging markets surge, policy stability (e.g., US tax credits) and technological innovation (e.g., solid-state batteries) will dictate long-term growth. Companies must prioritize sustainability (recycling, green tech), cost reduction, and policy engagement to capitalize on this $5.1 trillion opportunity.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]Energy Storage Market to be Driven by increasing population in the Forecast Period of 2025-2032

global energy storage market encompasses technologies and solutions that capture energy for later use, enabling grid stability, renewable integration, and energy resilience. Valued at $668.7 billion in 2024, the market is projected to reach $5.12 trillion by 2034, growing at a 21.7% CAGR 3. This includes:

Request Free Sample report:https://www.stellarmr.com/report/req_sample/Energy-Storage-Market/291

Technologies: Lithium-ion batteries, pumped hydro storage (PHS), thermal storage, and emerging solutions like gravity-based systems.

Applications: Grid stabilization, electric vehicles (EVs), residential backup, and industrial energy management.

The market's expansion is driven by decarbonization goals, renewable energy growth, and technological innovation.

Key Growth Drivers and Opportunities

Primary Catalysts:

Renewable Energy Integration: With 3,870 GW of global renewable capacity (86% of new additions in 2023), storage mitigates intermittency issues in solar/wind power 57.

EV Boom: 13.5 million EVs sold in 2023 (34% YoY growth), driving demand for high-density lithium-ion batteries 37.

Grid Modernization: Surging energy demand and extreme weather events necessitate storage for grid resilience. For example, Entergy (Louisiana) raised electricity rates after hurricanes, highlighting reliability needs 5.

Policy Support: The US Inflation Reduction Act (IRA) offers 30% tax credits for residential storage, while the EU’s Renewable Energy Directive targets 45% renewable energy by 2030 59.

Emerging Opportunities:

AI-Optimized Storage: Machine learning enhances battery performance and safety through real-time monitoring 3.

Second-Life Batteries: Repurposing EV batteries for grid storage reduces costs by 30–50% 3.

Green Technologies: Gravity storage (e.g., sand-based systems) and green hydrogen offer sustainable alternatives 35.

Emerging Markets: The Middle East and Africa project 381% YoY growth in 2025, led by Saudi Arabia and UAE 8.

Market Segmentation Analysis

By Technology:

Lithium-Ion Batteries: Dominates due to EV demand; holds >90% share in utility-scale projects 48.

Pumped Hydro Storage (PHS): Accounts for 35% market share; ideal for long-duration storage (e.g., Greenko’s 3.3 GW project in India) 37.

Emerging Solutions:

Sodium-ion batteries gain traction (e.g., China’s 2024 deployment).

Flow batteries for grid-scale applications 9.

By Application:

Utility-Scale: Largest segment (56% revenue share), driven by renewable firming (e.g., ENGIE’s 638 MWh project in Chile) 5.

Residential: Fastest-growing segment (18.7% CAGR), fueled by solar adoption and power outage concerns 57.

Commercial & Industrial (C&I): Uses storage for peak shaving and demand charge reductio

Competitive Landscape

Top Players: BYD, Samsung SDI, Tesla, LG Energy Solution, and Siemens control >40% market share 35.

BYD: Leads with Blade Battery tech; Q3 2024 revenue of $27.7 billion 3.

Siemens: Focuses on hydrogen storage and CAES; partnered for Texas CAES project 5.

Strategies:

Vertical Integration: CATL mass-produces solid-state batteries to cut costs 3.

Strategic Acquisitions: GridStor acquired 150 MW Texas project (2025) 3.

Regional Expansion: Chinese firms (e.g., Sungrow) dominate Middle East tenders via low bids 8.

Key Challenges

Policy Uncertainty: US tariffs on Chinese imports may raise system costs by 30%, risking 27% reduction in storage buildout 104.

Raw Material Volatility: Lithium price fluctuations threaten supply chains; EU promotes recycling via Battery Directive 9.

Environmental Impact: Battery production causes habitat destruction; recycling infrastructure remains underdeveloped 5.

Future Outlook (2025–2030)

Technology Shifts: Solid-state and sodium-ion batteries to capture 15% market share by 2030 9.

Global Targets: COP29 pledge to reach 1,500 GW storage by 2030 (6x 2022 levels) 9.

Capacity Growth: Annual additions to hit 220 GW/972 GWh by 2035, led by utility-scale projects 48.

AI Integration: Predictive maintenance and autonomous grid management to become standard

Conclusion

The energy storage market is pivotal to the global energy transition, driven by renewable integration, EV expansion, and grid resilience needs. While Asia-Pacific dominates and emerging markets surge, policy stability (e.g., US tax credits) and technological innovation (e.g., solid-state batteries) will dictate long-term growth. Companies must prioritize sustainability (recycling, green tech), cost reduction, and policy engagement to capitalize on this $5.1 trillion opportunity.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

+91 9607365656

[email protected]