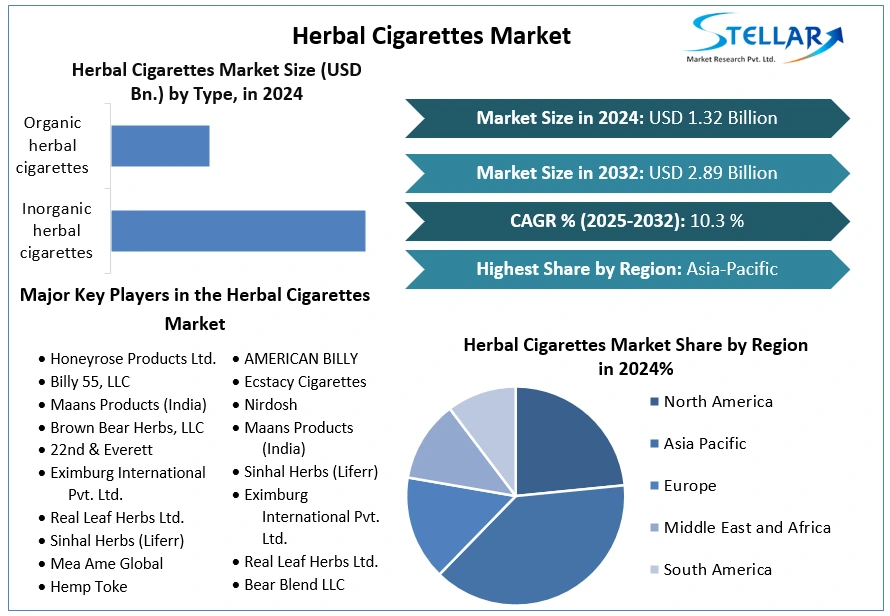

Herbal Cigarettes Market Size to Grow at a CAGR of 10.3% in the Forecast Period of 2025-2032

Herbal Cigarettes Market – A Growing Alternative to Conventional Tobacco

1. Market Estimation & Definition

The herbal cigarettes market is a niche yet expanding segment within the global smoking alternatives industry. Herbal cigarettes are crafted from blends of herbs, flowers, and other plant materials such as clover, lemongrass, corn silk, rose petals, mint, or lotus leaves instead of conventional tobacco. They are free from nicotine and often marketed as less addictive substitutes to traditional cigarettes. While herbal cigarettes still produce smoke and tar, they appeal to consumers seeking alternatives that align with wellness trends, smoking cessation programs, and lifestyle preferences.

According to Stellar Market Research, the herbal cigarettes market has shown steady expansion, supported by rising health awareness and increased consumer inclination toward tobacco-free options. The market value is set to grow consistently over the forecast period, with demand concentrated in both developed and emerging economies.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Herbal-Cigarettes-Market/1981

2. Market Growth Drivers & Opportunities

Several key drivers underpin market growth:

Rising Health Awareness: Growing recognition of the harmful effects of nicotine and tobacco use is motivating smokers to try alternatives such as herbal cigarettes.

Smoking Cessation Support: Herbal cigarettes are increasingly positioned as cessation aids, helping individuals transition away from traditional smoking.

Cultural & Lifestyle Shifts: Younger generations are exploring alternative lifestyles and wellness products, creating opportunities for herbal cigarettes to be marketed as natural and trendy.

Government Regulations on Tobacco: Stringent anti-tobacco regulations in many regions are indirectly creating space for alternatives, as consumers explore herbal or tobacco-free products.

Opportunities in Emerging Markets: Countries in Asia Pacific and parts of Europe present significant opportunities, as growing urban populations and exposure to global health trends stimulate demand.

3. What Lies Ahead: Emerging Trends Shaping the Future

Expansion of Natural & Organic Blends: Demand for organic, chemical-free blends is rising, with consumers seeking authentic wellness-oriented products.

Marketing Positioning as Lifestyle Products: Brands are increasingly promoting herbal cigarettes as part of holistic wellness or lifestyle choices, not just as cessation aids.

Flavor & Innovation: Companies are experimenting with new flavors and aroma profiles, such as mint, green tea, ginseng, and lavender, to attract wider audiences.

Online Retail Growth: E-commerce is emerging as a vital channel for niche products, enabling smaller brands to reach global consumers.

Integration with Smoking Alternatives: Herbal cigarettes may complement broader harm-reduction strategies, including vaping and nicotine-replacement therapies.

4. Segmentation Analysis

The herbal cigarettes market can be segmented as follows:

By Type:

• Flavored herbal cigarettes (mint, menthol, clove, fruit)

• Non-flavored herbal cigarettes (classic blends, natural herbs)

By Distribution Channel:

• Supermarkets and hypermarkets – capturing bulk purchases

• Convenience stores – key for impulse buyers

• Online retail – fastest-growing segment

• Specialty tobacco-free outlets and pharmacies

By End-User:

• Smokers seeking cessation support

• Lifestyle-oriented consumers exploring alternatives

5. Country-Level Analysis

United States: In the U.S., rising health consciousness and government regulation on tobacco sales encourage consumers to consider alternatives. Herbal cigarettes are often marketed as cessation aids and appeal to niche wellness-oriented segments.

Germany: Germany, with its strong culture of herbal remedies, presents opportunities for herbal cigarette adoption. Consumers are receptive to natural and plant-based substitutes, though regulatory scrutiny is high.

India: In India, herbal smoking alternatives draw on long traditions of ayurvedic and herbal remedies. The market is still small but growing rapidly as urban consumers explore non-tobacco lifestyles and wellness products.

6. Competitive Landscape Analysis

The herbal cigarettes market is moderately fragmented, with a mix of regional and international players. Companies compete based on blend quality, flavor innovation, organic certifications, and marketing strategies. Key players are experimenting with natural ingredients, packaging appeal, and positioning to attract both smokers seeking cessation and lifestyle-driven consumers. Strategic partnerships with online retailers and expansion into health-oriented distribution channels are becoming common competitive tactics.

7. Press Release Conclusion

The Herbal Cigarettes Market is poised for steady growth as consumer preferences shift toward tobacco-free and wellness-aligned alternatives. Although not without controversy regarding health risks, herbal cigarettes offer smokers a transitional product and lifestyle users a niche experience. With innovation in herbal blends, growing online retail availability, and supportive market trends across the U.S., Germany, India, and other regions, the industry is set for expansion in the coming years.

For stakeholders, the future lies in product differentiation, transparency in ingredient sourcing, and branding that aligns with wellness and lifestyle narratives. Herbal cigarettes may never replace traditional tobacco, but they are carving out a unique and growing space in the global smoking alternatives landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Herbal Cigarettes Market – A Growing Alternative to Conventional Tobacco

1. Market Estimation & Definition

The herbal cigarettes market is a niche yet expanding segment within the global smoking alternatives industry. Herbal cigarettes are crafted from blends of herbs, flowers, and other plant materials such as clover, lemongrass, corn silk, rose petals, mint, or lotus leaves instead of conventional tobacco. They are free from nicotine and often marketed as less addictive substitutes to traditional cigarettes. While herbal cigarettes still produce smoke and tar, they appeal to consumers seeking alternatives that align with wellness trends, smoking cessation programs, and lifestyle preferences.

According to Stellar Market Research, the herbal cigarettes market has shown steady expansion, supported by rising health awareness and increased consumer inclination toward tobacco-free options. The market value is set to grow consistently over the forecast period, with demand concentrated in both developed and emerging economies.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Herbal-Cigarettes-Market/1981

2. Market Growth Drivers & Opportunities

Several key drivers underpin market growth:

Rising Health Awareness: Growing recognition of the harmful effects of nicotine and tobacco use is motivating smokers to try alternatives such as herbal cigarettes.

Smoking Cessation Support: Herbal cigarettes are increasingly positioned as cessation aids, helping individuals transition away from traditional smoking.

Cultural & Lifestyle Shifts: Younger generations are exploring alternative lifestyles and wellness products, creating opportunities for herbal cigarettes to be marketed as natural and trendy.

Government Regulations on Tobacco: Stringent anti-tobacco regulations in many regions are indirectly creating space for alternatives, as consumers explore herbal or tobacco-free products.

Opportunities in Emerging Markets: Countries in Asia Pacific and parts of Europe present significant opportunities, as growing urban populations and exposure to global health trends stimulate demand.

3. What Lies Ahead: Emerging Trends Shaping the Future

Expansion of Natural & Organic Blends: Demand for organic, chemical-free blends is rising, with consumers seeking authentic wellness-oriented products.

Marketing Positioning as Lifestyle Products: Brands are increasingly promoting herbal cigarettes as part of holistic wellness or lifestyle choices, not just as cessation aids.

Flavor & Innovation: Companies are experimenting with new flavors and aroma profiles, such as mint, green tea, ginseng, and lavender, to attract wider audiences.

Online Retail Growth: E-commerce is emerging as a vital channel for niche products, enabling smaller brands to reach global consumers.

Integration with Smoking Alternatives: Herbal cigarettes may complement broader harm-reduction strategies, including vaping and nicotine-replacement therapies.

4. Segmentation Analysis

The herbal cigarettes market can be segmented as follows:

By Type:

• Flavored herbal cigarettes (mint, menthol, clove, fruit)

• Non-flavored herbal cigarettes (classic blends, natural herbs)

By Distribution Channel:

• Supermarkets and hypermarkets – capturing bulk purchases

• Convenience stores – key for impulse buyers

• Online retail – fastest-growing segment

• Specialty tobacco-free outlets and pharmacies

By End-User:

• Smokers seeking cessation support

• Lifestyle-oriented consumers exploring alternatives

5. Country-Level Analysis

United States: In the U.S., rising health consciousness and government regulation on tobacco sales encourage consumers to consider alternatives. Herbal cigarettes are often marketed as cessation aids and appeal to niche wellness-oriented segments.

Germany: Germany, with its strong culture of herbal remedies, presents opportunities for herbal cigarette adoption. Consumers are receptive to natural and plant-based substitutes, though regulatory scrutiny is high.

India: In India, herbal smoking alternatives draw on long traditions of ayurvedic and herbal remedies. The market is still small but growing rapidly as urban consumers explore non-tobacco lifestyles and wellness products.

6. Competitive Landscape Analysis

The herbal cigarettes market is moderately fragmented, with a mix of regional and international players. Companies compete based on blend quality, flavor innovation, organic certifications, and marketing strategies. Key players are experimenting with natural ingredients, packaging appeal, and positioning to attract both smokers seeking cessation and lifestyle-driven consumers. Strategic partnerships with online retailers and expansion into health-oriented distribution channels are becoming common competitive tactics.

7. Press Release Conclusion

The Herbal Cigarettes Market is poised for steady growth as consumer preferences shift toward tobacco-free and wellness-aligned alternatives. Although not without controversy regarding health risks, herbal cigarettes offer smokers a transitional product and lifestyle users a niche experience. With innovation in herbal blends, growing online retail availability, and supportive market trends across the U.S., Germany, India, and other regions, the industry is set for expansion in the coming years.

For stakeholders, the future lies in product differentiation, transparency in ingredient sourcing, and branding that aligns with wellness and lifestyle narratives. Herbal cigarettes may never replace traditional tobacco, but they are carving out a unique and growing space in the global smoking alternatives landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Herbal Cigarettes Market Size to Grow at a CAGR of 10.3% in the Forecast Period of 2025-2032

Herbal Cigarettes Market – A Growing Alternative to Conventional Tobacco

1. Market Estimation & Definition

The herbal cigarettes market is a niche yet expanding segment within the global smoking alternatives industry. Herbal cigarettes are crafted from blends of herbs, flowers, and other plant materials such as clover, lemongrass, corn silk, rose petals, mint, or lotus leaves instead of conventional tobacco. They are free from nicotine and often marketed as less addictive substitutes to traditional cigarettes. While herbal cigarettes still produce smoke and tar, they appeal to consumers seeking alternatives that align with wellness trends, smoking cessation programs, and lifestyle preferences.

According to Stellar Market Research, the herbal cigarettes market has shown steady expansion, supported by rising health awareness and increased consumer inclination toward tobacco-free options. The market value is set to grow consistently over the forecast period, with demand concentrated in both developed and emerging economies.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Herbal-Cigarettes-Market/1981

2. Market Growth Drivers & Opportunities

Several key drivers underpin market growth:

Rising Health Awareness: Growing recognition of the harmful effects of nicotine and tobacco use is motivating smokers to try alternatives such as herbal cigarettes.

Smoking Cessation Support: Herbal cigarettes are increasingly positioned as cessation aids, helping individuals transition away from traditional smoking.

Cultural & Lifestyle Shifts: Younger generations are exploring alternative lifestyles and wellness products, creating opportunities for herbal cigarettes to be marketed as natural and trendy.

Government Regulations on Tobacco: Stringent anti-tobacco regulations in many regions are indirectly creating space for alternatives, as consumers explore herbal or tobacco-free products.

Opportunities in Emerging Markets: Countries in Asia Pacific and parts of Europe present significant opportunities, as growing urban populations and exposure to global health trends stimulate demand.

3. What Lies Ahead: Emerging Trends Shaping the Future

Expansion of Natural & Organic Blends: Demand for organic, chemical-free blends is rising, with consumers seeking authentic wellness-oriented products.

Marketing Positioning as Lifestyle Products: Brands are increasingly promoting herbal cigarettes as part of holistic wellness or lifestyle choices, not just as cessation aids.

Flavor & Innovation: Companies are experimenting with new flavors and aroma profiles, such as mint, green tea, ginseng, and lavender, to attract wider audiences.

Online Retail Growth: E-commerce is emerging as a vital channel for niche products, enabling smaller brands to reach global consumers.

Integration with Smoking Alternatives: Herbal cigarettes may complement broader harm-reduction strategies, including vaping and nicotine-replacement therapies.

4. Segmentation Analysis

The herbal cigarettes market can be segmented as follows:

By Type:

• Flavored herbal cigarettes (mint, menthol, clove, fruit)

• Non-flavored herbal cigarettes (classic blends, natural herbs)

By Distribution Channel:

• Supermarkets and hypermarkets – capturing bulk purchases

• Convenience stores – key for impulse buyers

• Online retail – fastest-growing segment

• Specialty tobacco-free outlets and pharmacies

By End-User:

• Smokers seeking cessation support

• Lifestyle-oriented consumers exploring alternatives

5. Country-Level Analysis

United States: In the U.S., rising health consciousness and government regulation on tobacco sales encourage consumers to consider alternatives. Herbal cigarettes are often marketed as cessation aids and appeal to niche wellness-oriented segments.

Germany: Germany, with its strong culture of herbal remedies, presents opportunities for herbal cigarette adoption. Consumers are receptive to natural and plant-based substitutes, though regulatory scrutiny is high.

India: In India, herbal smoking alternatives draw on long traditions of ayurvedic and herbal remedies. The market is still small but growing rapidly as urban consumers explore non-tobacco lifestyles and wellness products.

6. Competitive Landscape Analysis

The herbal cigarettes market is moderately fragmented, with a mix of regional and international players. Companies compete based on blend quality, flavor innovation, organic certifications, and marketing strategies. Key players are experimenting with natural ingredients, packaging appeal, and positioning to attract both smokers seeking cessation and lifestyle-driven consumers. Strategic partnerships with online retailers and expansion into health-oriented distribution channels are becoming common competitive tactics.

7. Press Release Conclusion

The Herbal Cigarettes Market is poised for steady growth as consumer preferences shift toward tobacco-free and wellness-aligned alternatives. Although not without controversy regarding health risks, herbal cigarettes offer smokers a transitional product and lifestyle users a niche experience. With innovation in herbal blends, growing online retail availability, and supportive market trends across the U.S., Germany, India, and other regions, the industry is set for expansion in the coming years.

For stakeholders, the future lies in product differentiation, transparency in ingredient sourcing, and branding that aligns with wellness and lifestyle narratives. Herbal cigarettes may never replace traditional tobacco, but they are carving out a unique and growing space in the global smoking alternatives landscape.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Commentarios

0 Acciones

319 Views