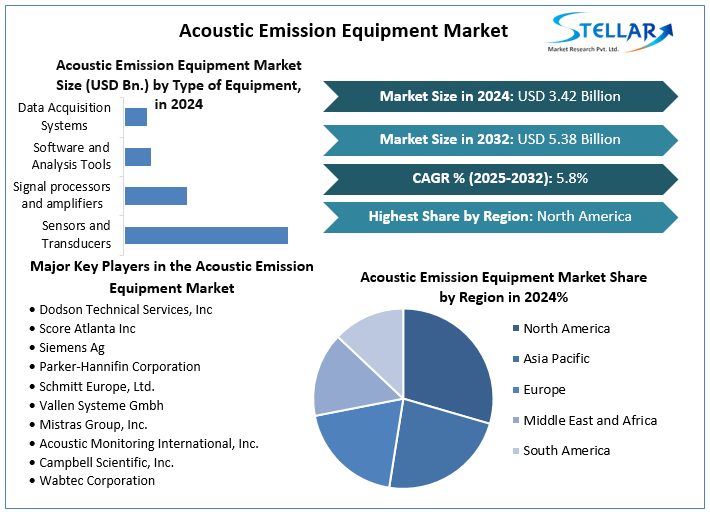

Acoustic Emission Equipment Market Size to Grow at a CAGR of 5.8 % in the Forecast Period of 2025-2032

Acoustic Emission Equipment Market Overview

The global Acoustic Emission (AE) Equipment Market is experiencing steady growth, driven by increasing demand for real-time structural health monitoring and non-destructive testing across various industries. AE equipment plays a crucial role in detecting and analyzing stress waves generated by material deformation, enabling early identification of potential failures in critical infrastructure.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Acoustic-Emission-Equipment-Market/1513

Market Size and Forecast

2024: The market was valued at approximately USD 1.2 billion.

2033: Projected to reach around USD 2.4 billion, reflecting a compound annual growth rate (CAGR) of 8.5% from 2026 to 2033

Key Market Drivers

Industrial Safety and Asset Integrity: Ensuring the safety and integrity of critical infrastructure such as pipelines, storage tanks, pressure vessels, and bridges is a primary factor driving the adoption of AE technology. AE equipment helps in monitoring these structures to detect flaws, cracks, and anomalies that could lead to catastrophic failures

Stringent Safety Regulations: Industries such as aerospace, oil & gas, and manufacturing are subject to stringent safety regulations, prompting the need for advanced monitoring solutions like AE equipment to comply with safety standards.

Technological Advancements: Advancements in sensor technology and data acquisition systems are enhancing the capabilities of AE equipment, making it more efficient and effective in detecting and analyzing acoustic emissions.

Market Segmentation

By Application: The AE equipment market is segmented into structural health monitoring, leak detection, machine condition monitoring, and other applications. Structural health monitoring is a major application, as it provides a non-invasive and efficient method to assess the integrity of structures

By End-Use Industry: Key industries utilizing AE equipment include aerospace, automotive, oil & gas, power generation, manufacturing, chemical, civil engineering, and shipbuilding.

Regional Insights

North America: Expected to dominate the AE equipment market due to early adoption of technology and substantial government funding in infrastructure projects.

Europe: Experiencing steady growth driven by regulatory requirements and emphasis on public safety in critical infrastructure.

Asia-Pacific: Anticipated to witness significant growth owing to rapid industrialization and infrastructure development in countries like China and India.

Conclusion

The Acoustic Emission Equipment Market is poised for substantial growth, driven by the increasing need for real-time monitoring solutions to ensure the safety and integrity of critical infrastructure. Advancements in technology and stringent safety regulations are further propelling the adoption of AE equipment across various industries. Stakeholders are encouraged to invest in AE technology to enhance operational efficiency and comply with safety standards.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Acoustic Emission Equipment Market Overview

The global Acoustic Emission (AE) Equipment Market is experiencing steady growth, driven by increasing demand for real-time structural health monitoring and non-destructive testing across various industries. AE equipment plays a crucial role in detecting and analyzing stress waves generated by material deformation, enabling early identification of potential failures in critical infrastructure.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Acoustic-Emission-Equipment-Market/1513

Market Size and Forecast

2024: The market was valued at approximately USD 1.2 billion.

2033: Projected to reach around USD 2.4 billion, reflecting a compound annual growth rate (CAGR) of 8.5% from 2026 to 2033

Key Market Drivers

Industrial Safety and Asset Integrity: Ensuring the safety and integrity of critical infrastructure such as pipelines, storage tanks, pressure vessels, and bridges is a primary factor driving the adoption of AE technology. AE equipment helps in monitoring these structures to detect flaws, cracks, and anomalies that could lead to catastrophic failures

Stringent Safety Regulations: Industries such as aerospace, oil & gas, and manufacturing are subject to stringent safety regulations, prompting the need for advanced monitoring solutions like AE equipment to comply with safety standards.

Technological Advancements: Advancements in sensor technology and data acquisition systems are enhancing the capabilities of AE equipment, making it more efficient and effective in detecting and analyzing acoustic emissions.

Market Segmentation

By Application: The AE equipment market is segmented into structural health monitoring, leak detection, machine condition monitoring, and other applications. Structural health monitoring is a major application, as it provides a non-invasive and efficient method to assess the integrity of structures

By End-Use Industry: Key industries utilizing AE equipment include aerospace, automotive, oil & gas, power generation, manufacturing, chemical, civil engineering, and shipbuilding.

Regional Insights

North America: Expected to dominate the AE equipment market due to early adoption of technology and substantial government funding in infrastructure projects.

Europe: Experiencing steady growth driven by regulatory requirements and emphasis on public safety in critical infrastructure.

Asia-Pacific: Anticipated to witness significant growth owing to rapid industrialization and infrastructure development in countries like China and India.

Conclusion

The Acoustic Emission Equipment Market is poised for substantial growth, driven by the increasing need for real-time monitoring solutions to ensure the safety and integrity of critical infrastructure. Advancements in technology and stringent safety regulations are further propelling the adoption of AE equipment across various industries. Stakeholders are encouraged to invest in AE technology to enhance operational efficiency and comply with safety standards.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

Acoustic Emission Equipment Market Size to Grow at a CAGR of 5.8 % in the Forecast Period of 2025-2032

Acoustic Emission Equipment Market Overview

The global Acoustic Emission (AE) Equipment Market is experiencing steady growth, driven by increasing demand for real-time structural health monitoring and non-destructive testing across various industries. AE equipment plays a crucial role in detecting and analyzing stress waves generated by material deformation, enabling early identification of potential failures in critical infrastructure.

Request Free Sample Report:https://www.stellarmr.com/report/req_sample/Acoustic-Emission-Equipment-Market/1513

Market Size and Forecast

2024: The market was valued at approximately USD 1.2 billion.

2033: Projected to reach around USD 2.4 billion, reflecting a compound annual growth rate (CAGR) of 8.5% from 2026 to 2033

Key Market Drivers

Industrial Safety and Asset Integrity: Ensuring the safety and integrity of critical infrastructure such as pipelines, storage tanks, pressure vessels, and bridges is a primary factor driving the adoption of AE technology. AE equipment helps in monitoring these structures to detect flaws, cracks, and anomalies that could lead to catastrophic failures

Stringent Safety Regulations: Industries such as aerospace, oil & gas, and manufacturing are subject to stringent safety regulations, prompting the need for advanced monitoring solutions like AE equipment to comply with safety standards.

Technological Advancements: Advancements in sensor technology and data acquisition systems are enhancing the capabilities of AE equipment, making it more efficient and effective in detecting and analyzing acoustic emissions.

Market Segmentation

By Application: The AE equipment market is segmented into structural health monitoring, leak detection, machine condition monitoring, and other applications. Structural health monitoring is a major application, as it provides a non-invasive and efficient method to assess the integrity of structures

By End-Use Industry: Key industries utilizing AE equipment include aerospace, automotive, oil & gas, power generation, manufacturing, chemical, civil engineering, and shipbuilding.

Regional Insights

North America: Expected to dominate the AE equipment market due to early adoption of technology and substantial government funding in infrastructure projects.

Europe: Experiencing steady growth driven by regulatory requirements and emphasis on public safety in critical infrastructure.

Asia-Pacific: Anticipated to witness significant growth owing to rapid industrialization and infrastructure development in countries like China and India.

Conclusion

The Acoustic Emission Equipment Market is poised for substantial growth, driven by the increasing need for real-time monitoring solutions to ensure the safety and integrity of critical infrastructure. Advancements in technology and stringent safety regulations are further propelling the adoption of AE equipment across various industries. Stakeholders are encouraged to invest in AE technology to enhance operational efficiency and comply with safety standards.

About us

Phase 3,Navale IT Zone, S.No. 51/2A/2,

Office No. 202, 2nd floor,

Near, Navale Brg,Narhe,

Pune, Maharashtra 411041

[email protected]

0 Reacties

0 aandelen

648 Views