How Does Centralized and Decentralized Crypto Exchange Software Work?

Understanding the Core Mechanisms, Features, and Benefits of CEX and DEX Platforms

Introduction

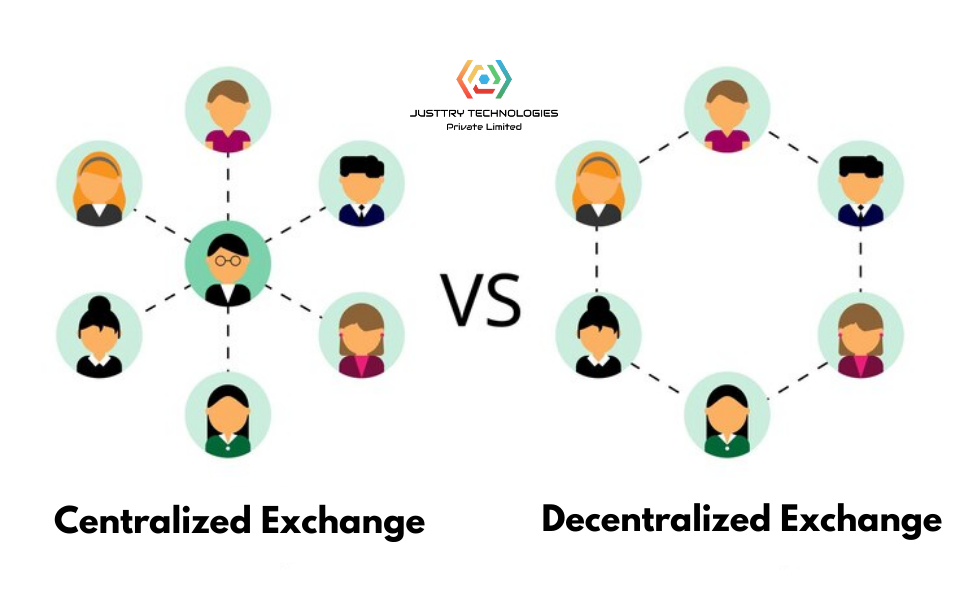

If you're diving into the world of cryptocurrency—whether to invest, trade, or build your own platform—you’ll definitely come across two major types of exchanges: centralized (CEX) and decentralized (DEX). Both have the same mission—to help users buy, sell, and trade digital assets—but they go about it in totally different ways.

Let’s break it all down in simple terms so you can decide which is right for your goals.

What is a Crypto Exchange?

A crypto exchange is like the Wall Street of digital currency. It’s a platform that allows you to buy, sell, or trade cryptocurrencies such as Bitcoin, Ethereum, or stablecoins.

There are two primary types:

Centralized Exchanges (CEX)

Decentralized Exchanges (DEX)

Each has its own strengths and trade-offs.

How Does a Centralized Crypto Exchange Work?

A CEX is run by a company that acts as a middleman between buyers and sellers.

Here's how it usually works:

User Registration

: Sign up, complete KYC (Know Your Customer), and verify identity.

Deposit Funds

: Users deposit crypto or fiat currencies into wallets managed by the platform.

Order Matching Engine

: The exchange matches buy/sell orders internally.

Trade Execution

: Once matched, trades are executed instantly.

Withdrawals

: Users can withdraw their crypto or fiat anytime.

Key Features of Centralized Exchanges:

High liquidity

Custodial wallets

Fiat support (cards, banks)

Customer support

Popular CEX examples: Binance, Coinbase, Kraken.

Partnering with a centralized crypto exchange development company ensures your platform has:

Secure backend infrastructure

Admin dashboards

KYC/AML integrations

Mobile + web apps

How Does a Decentralized Crypto Exchange Work?

On the flip side, a DEX operates on the blockchain—no middlemen involved.

How it works:

Wallet Connection

: Users connect their own wallets (e.g., MetaMask).

Smart Contract Activation

: Trades are handled by self-executing smart contracts.

P2P Trading

: Users trade directly with one another.

Instant Blockchain Settlement

: All trades are recorded on-chain for transparency.

Core Features of DEXs:

Non-custodial (users own their keys)

No KYC needed

Open-source and community-driven

Popular DEX examples: Uniswap, SushiSwap, PancakeSwap.

Benefits of DEX:

Full control over your funds

Greater privacy

Lower risk of hacking attacks

Censorship-resistant

Need help launching your own DEX? A decentralized crypto exchange development service can help build secure, fast, and scalable blockchain platforms.

CEX vs DEX: Which One’s for You?

Feature Centralized Exchange Decentralized Exchange

Custody Platform-controlled

User-controlled

Speed Fast (off-chain)

Slower (on-chain)

Privacy KYC required

No KYC

Liquidity Generally higher

Varies with pools

Why Choose JustTry Technologies as Your Development Partner

Building a crypto exchange is no small feat. You need a trusted partner with hands-on blockchain experience. That’s where JustTry Technologies shines.

We Offer:

CEX Solutions: Trading engines, admin panels, fiat integrations.

DEX Solutions: AMMs, smart contract coding, decentralized protocols.

Hybrid Platforms: Best of both worlds—CEX UI + DEX security.

Why Work With Us?

Blockchain experts

Regulatory-ready (KYC/AML/GDPR)

Scalable architecture for growth

Complete project lifecycle support

From idea

to launch

to ongoing maintenance

—we’ve got your back.

Visit:

https://justtrytech.com/cryptocurrency-exchange-development-company/ https://justtrytech.com/centralized-crypto-exchange-development/ https://justtrytech.com/decentralized-exchange-development/How Does Centralized and Decentralized Crypto Exchange Software Work?

Understanding the Core Mechanisms, Features, and Benefits of CEX and DEX Platforms

🚀 Introduction

If you're diving into the world of cryptocurrency—whether to invest, trade, or build your own platform—you’ll definitely come across two major types of exchanges: centralized (CEX) and decentralized (DEX). Both have the same mission—to help users buy, sell, and trade digital assets—but they go about it in totally different ways.

Let’s break it all down in simple terms so you can decide which is right for your goals. 💡

🔄 What is a Crypto Exchange?

A crypto exchange is like the Wall Street of digital currency. It’s a platform that allows you to buy, sell, or trade cryptocurrencies such as Bitcoin, Ethereum, or stablecoins.

There are two primary types:

Centralized Exchanges (CEX)

Decentralized Exchanges (DEX)

Each has its own strengths and trade-offs.

🏛️ How Does a Centralized Crypto Exchange Work?

A CEX is run by a company that acts as a middleman between buyers and sellers.

👨💼 Here's how it usually works:

User Registration 🧾: Sign up, complete KYC (Know Your Customer), and verify identity.

Deposit Funds 💵: Users deposit crypto or fiat currencies into wallets managed by the platform.

Order Matching Engine ⚙️: The exchange matches buy/sell orders internally.

Trade Execution ⚡: Once matched, trades are executed instantly.

Withdrawals 🔐: Users can withdraw their crypto or fiat anytime.

✨ Key Features of Centralized Exchanges:

High liquidity 💧

Custodial wallets 🏦

Fiat support (cards, banks) 💳

Customer support 👩💻

📌 Popular CEX examples: Binance, Coinbase, Kraken.

👉 Partnering with a centralized crypto exchange development company ensures your platform has:

Secure backend infrastructure 🔐

Admin dashboards 📊

KYC/AML integrations ✅

Mobile + web apps 📱💻

🌐 How Does a Decentralized Crypto Exchange Work?

On the flip side, a DEX operates on the blockchain—no middlemen involved. 🕸️

👣 How it works:

Wallet Connection 🔗: Users connect their own wallets (e.g., MetaMask).

Smart Contract Activation 🤖: Trades are handled by self-executing smart contracts.

P2P Trading 🤝: Users trade directly with one another.

Instant Blockchain Settlement 🧾: All trades are recorded on-chain for transparency.

🔑 Core Features of DEXs:

Non-custodial (users own their keys) 🔐

No KYC needed 🕵️♂️

Open-source and community-driven 🌍

🧪 Popular DEX examples: Uniswap, SushiSwap, PancakeSwap.

💥 Benefits of DEX:

Full control over your funds 🔓

Greater privacy 🔍

Lower risk of hacking attacks 👾

Censorship-resistant ✊

Need help launching your own DEX? A decentralized crypto exchange development service can help build secure, fast, and scalable blockchain platforms.

⚖️ CEX vs DEX: Which One’s for You?

Feature Centralized Exchange Decentralized Exchange

Custody Platform-controlled 🔒 User-controlled 🔑

Speed Fast (off-chain) ⚡ Slower (on-chain) 🐢

Privacy KYC required 🧾 No KYC 🕶️

Liquidity Generally higher 💰 Varies with pools 🌀

🏗️ Why Choose JustTry Technologies as Your Development Partner

Building a crypto exchange is no small feat. You need a trusted partner with hands-on blockchain experience. That’s where JustTry Technologies shines. 🌟

🎯 We Offer:

CEX Solutions: Trading engines, admin panels, fiat integrations.

DEX Solutions: AMMs, smart contract coding, decentralized protocols.

Hybrid Platforms: Best of both worlds—CEX UI + DEX security.

💼 Why Work With Us?

Blockchain experts 🧠

Regulatory-ready (KYC/AML/GDPR) 📜

Scalable architecture for growth 📈

Complete project lifecycle support 🔁

From idea 💡 to launch 🚀 to ongoing maintenance 🔧—we’ve got your back.

Visit: https://justtrytech.com/cryptocurrency-exchange-development-company/

https://justtrytech.com/centralized-crypto-exchange-development/

https://justtrytech.com/decentralized-exchange-development/