Market Overview:

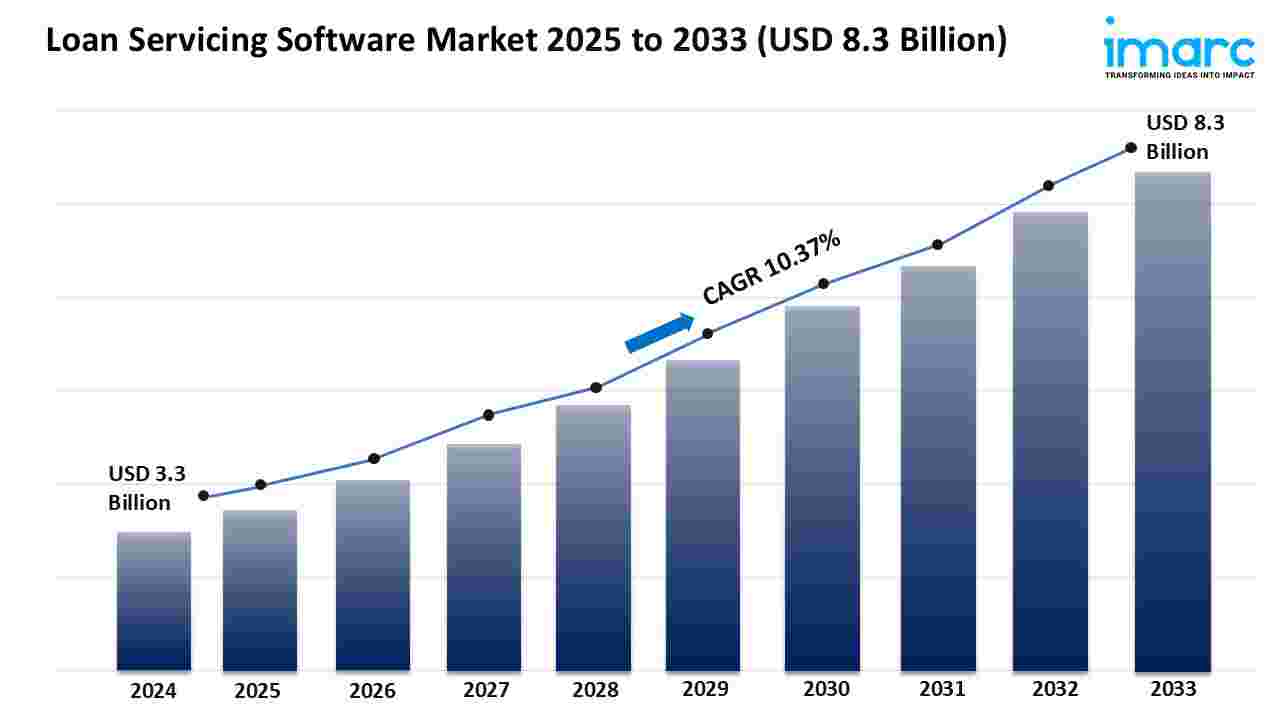

The loan servicing software market is experiencing rapid growth, driven by rising demand for automation in lending processes, increasing focus on regulatory compliance, and growing adoption of digital banking solutions. According to IMARC Group’s latest research publication, “Loan Servicing Software Market by Component (Software, Services), Deployment Mode (On-premises, Cloud-based), Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises), End User (Banks, Credit Unions, Mortgage Lenders and Brokers, and Others), and Region 2025-2033”, the global loan servicing software market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/loan-servicing-software-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Loan Servicing Software Market

- Rising Demand for Automation in Lending Processes

The global loan servicing software market size in 2024 reflects a strong push for automation, as financial institutions aim to streamline operations and cut costs. Banks and lenders are adopting software to automate repetitive tasks like payment processing, escrow management, and compliance checks, reducing manual errors and boosting efficiency. For instance, a report highlights that loan servicing software can speed up application processing by up to 50%, saving time and resources. Companies like Sagent launched platforms like Dara in February 2024, which consolidates data for seamless loan lifecycle management. This automation trend is fueled by the need to handle growing loan portfolios, especially in regions like North America, where digital banking solutions saw $80 billion in investments in 2023.

- Increasing Focus on Regulatory Compliance

Stricter regulations are a major driver for the loan servicing software market size in 2024, as financial institutions must comply with laws like GDPR and CCPA. Software solutions help ensure compliance by automating reporting and tracking borrower data securely. For example, CompassWay’s software, launched in June 2024, uses AI to enhance regulatory adherence for small business lending. Government initiatives, like the UK’s digital sector contributing $171.25 million to the economy, encourage tech adoption to meet compliance needs. These platforms reduce the risk of penalties and improve transparency, which is critical as global loan volumes rise. In the U.S., where personal and home loans are surging, compliance-focused software is essential for managing complex regulations, driving widespread adoption across banks and credit unions.

- Growing Adoption of Digital Banking Solutions

The loan servicing software market size in 2024 is expanding due to the rise of digital banking, driven by consumer demand for convenient, online financial services. With 72% of banking customers preferring online transactions, lenders are investing in software to offer self-service portals and mobile apps for loan management. For instance, LoanStreet Inc. introduced a corporate loan servicing platform in February 2024, enhancing borrower experiences through digital tools. The World Bank noted a 25% increase in digital financial service usage during the pandemic, a trend that continues to push software adoption. This shift allows lenders to provide real-time data access and improve customer satisfaction, particularly in regions like Asia-Pacific, where digital loan services are rapidly growing.

Key Trends in the Loan Servicing Software Market

- Integration of Artificial Intelligence and Machine Learning

AI and machine learning are transforming the loan servicing software market size in 2024 by enabling smarter decision-making and risk assessment. These technologies analyze borrower data to identify trends, improving loan approvals and customer profiling. For example, CompassWay’s June 2024 software launch uses AI to streamline small business lending, reducing errors and enhancing efficiency. AI-driven platforms can cut processing times significantly, with some reports noting up to 30% faster loan approvals. This trend is particularly strong in North America, where financial institutions are investing heavily in AI to stay competitive. By automating tasks like document categorization and credit scoring, AI enhances accuracy and customer trust, making it a game-changer for lenders aiming to scale operations and meet rising demand.

- Adoption of Cloud-Based Solutions

Cloud-based loan servicing software is gaining traction in 2024, driven by its flexibility and cost-effectiveness. Over 60% of new deployments are cloud-based, as they eliminate upfront infrastructure costs and enable remote access. For instance, AFS’s AFSVision platform, adopted by SouthState Bank in November 2024, offers real-time analytics and scalability for complex loan portfolios. Cloud solutions support seamless integration with other financial systems, boosting operational efficiency. In Asia-Pacific, where digital loan services are surging, cloud platforms are critical for handling growing loan volumes. This trend appeals to both large banks and SMEs, as it reduces costs and supports hybrid work environments, aligning with the global shift toward digital transformation in financial services.

- Focus on Personalized Loan Products

The loan servicing software market size in 2024 is seeing a shift toward personalized loan products, driven by consumer demand for tailored financial solutions. Software now uses data analytics to customize loan terms based on borrower profiles, improving satisfaction. For example, platforms like Calyx Software, partnered with PrivoCorp in April 2024, enable lenders to offer personalized mortgage options through advanced analytics. This trend is evident in regions like North America, where 72% of customers prefer digital banking for convenience. By leveraging real-time data, lenders can create flexible repayment plans, enhancing borrower engagement. This focus on personalization not only boosts customer loyalty but also helps lenders stand out in a competitive market, driving software adoption.

Leading Companies Operating in the Loan Servicing Software Industry:

- Altisource

- Applied Business Software

- Bryt Software LCC

- C-Loans Inc.

- Emphasys Software (Constellation Software)

- Financial Industry Computer Systems Inc.

- Fiserv Inc.

- GOLDPoint Systems Inc.

- Graveco Software Inc.

- LoanPro

- Nortridge Software LLC

- Q2 Software Inc. (Q2 Holdings Inc.)

- Shaw Systems Associates LLC.

Loan Servicing Software Market Report Segmentation:

By Component :

- Software

- Services

The loan servicing software market is primarily composed of software and services, with software being the largest segment.

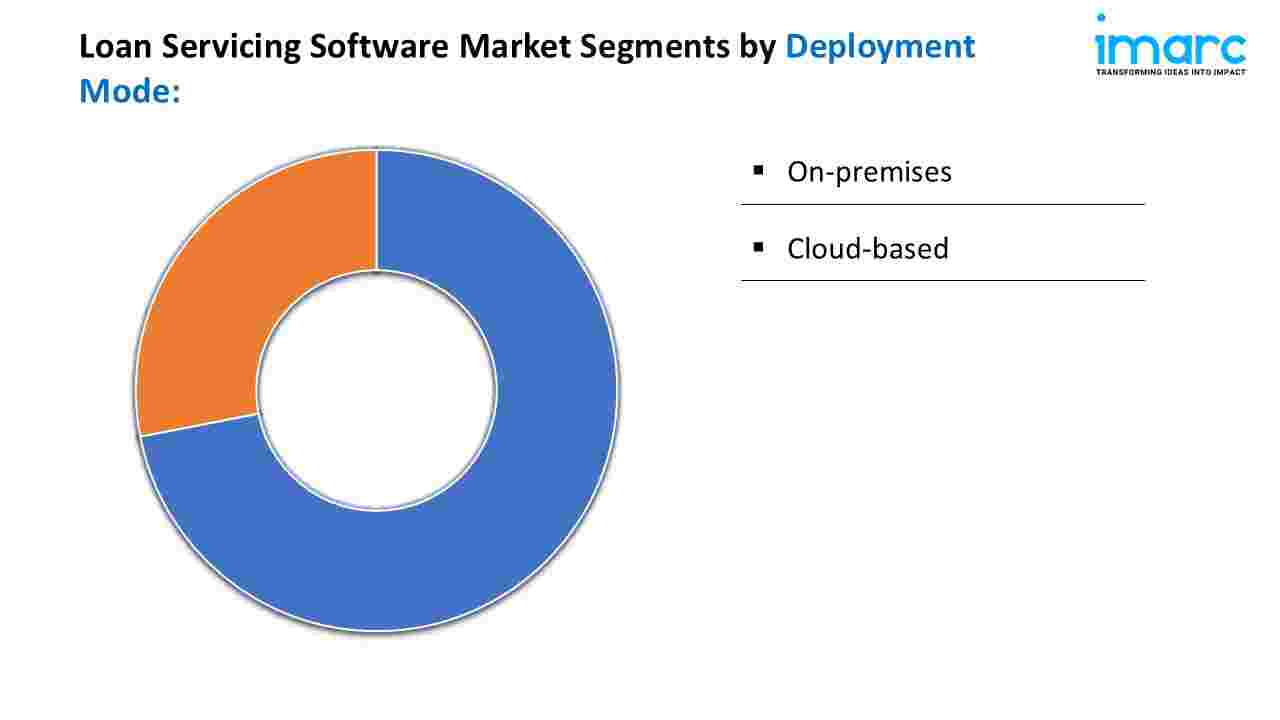

By Deployment Mode:

- On-premises

- Cloud-based

The market analysis reveals that cloud-based deployment holds the largest market share compared to on-premises solutions.

By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises dominate the loan servicing software market, as highlighted in the analysis of enterprise size.

By End User:

- Banks

- Credit Unions

- Mortgage Lenders and Brokers

- Others

Banks represent the largest segment among end users in the loan servicing software market, followed by credit unions and mortgage lenders.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America, driven by growth in the BFSI sector and technology integration, is the largest market for loan servicing software, encompassing the United States and Canada, along with other global regions.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145